Diversity, Equality and Inclusion in African Private Capital

AVCA 2022 Roundtable in Collaboration With 2X Challenge — Sponsored by Kuramo Capital

Diversity, Equality, and Inclusion (DEI) have become major priorities for governments, international organisations, and business leaders globally. Besides being increasingly recognised as a moral imperative, integrating DEI principles within organisations’ operations is also increasingly being accepted as contributing positively to performance and critical to ensuring their long-term sustainability.

Narrowing the lens, the DEI debate is certainly topical and relevant within the global private capital community. There is now a wide range of research supporting the premise that increasing implementation of these principles by capital allocators can transform the global business community, improve performance, and reduce risks. More recently, social justice movements (including Black Lives Matter and #MeToo) in the Global North have reignited conversations on the need for increased DEI in corporate practice. However, the relevance of diversity, equity and inclusion exists far beyond America’s unique socio-political context, as similar questions of racial and gender bias exist throughout post-colonial Africa. Some statistics that corroborate the perception of DEI imbalances in the African private capital ecosystem include:

· Only 6% of start-ups that secured more than US$1 million in funding in 2019 were led by indigenous founders[1] — a statistic that contributes to the widespread perception of venture bias in the industry, where expatriate or foreign educated founders are considered more likely to successfully raise capital than their local counterparts.

· In 2017, women made up just 12% of senior investment professionals within fund management firms in sub-Saharan Africa, lagging behind the combined average for other industries in the region, which stands at 29%[2].

· 24% of deals struck in 2021 went to diverse founding teams[3] (i.e., those that were either entirely female led, or counted at least one female in the founding cohort).

· Start-ups with women in senior leadership roles raised a cumulative total of US$150 million in 2021 — which corresponds to less than 3% of the US$5.2 billion of venture capital investors put to work on the continent last year[4].

· Female entrepreneurs and women led businesses in Africa face a US$42 billion financing gap annually, compared to their male counterparts[5].

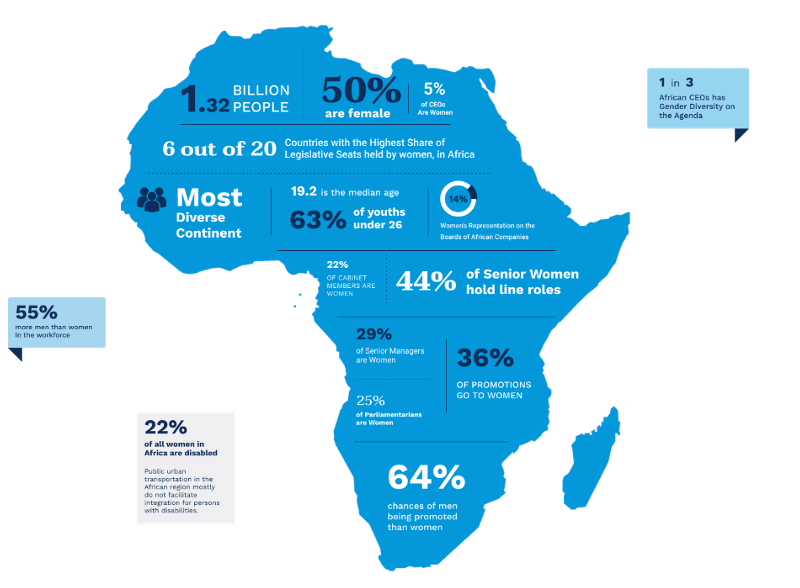

Beyond the private capital industry, data on women’s leadership and participation in economic activities[6] also shows ample room for improvement, despite evidence supporting the strong positive correlation between diversity and performance.

Companies with greater diversity in leadership roles are more likely to outperform those with less diverse leadership (based on industry averages of margin growth)[7]. Closing the gender labour gap in Africa stands to add US$316 billion (equivalent to 10% of Africa’s annual GDP) by 2025, thus highlighting the strong commercial case for gender-lens investing[8]. Given the well-documented positive effects of championing DEI in the corporate arena, both morally and commercially, a pertinent question arises. Why do gender, racial and ethnic inequalities within Africa’s private capital industry persist, particularly when there is a recognised problem, and a profitable solution?

Recognising the importance of DEI as a strategic objective in private capital, the African Private Equity and Venture Capital Association, in partnership with the 2X Collaborative, hosted a Diversity, Equality and Inclusion Roundtable at the AVCA 2022 Annual Conference in Dakar, Senegal. The Roundtable was sponsored by Kuramo Capital Management, a leader in promoting indigenous managers and convened leaders from top institutional investors and private equity firms, who discussed how far capital raising, capital allocation and investment strategies in Africa’s PE & VC industries are from being truly inclusive and provided solutions to further advance this principle within the sector. Key takeaways from the discussion include:

· INDIGENOUS FUND MANAGERS ARE ON THE RISE. Roundtable participants applauded the remarkable improvement in the number of indigenous fund managers in Africa, compared to a decade ago. Nevertheless, they conceded that a lot of work still needs to be done to further support indigenous investors raising capital.

· A PARADIGM SHIFT IS LONG OVERDUE. The conversation should shift away from whether indigenous fund managers have been able to raise capital and instead focus on the openness of investors to accepting the strategies and solutions proposed by indigenous fund managers, who have first-hand knowledge of the problems in their local environments.

· THE ONUS IS ON CAPITAL ALLOCATORS TO CHAMPION INCLUSIVITY. When exploring the historical contributors for existing inequalities in Africa’s private capital industry, the importance of diversity at the capital allocator level was emphasised. “If we don’t have indigenous managers and female owned funds that are investing,” respondents noted, “we are not going to see indigenous entrepreneurs and female businesses being backed’’.

· DEI PRINCIPLES DO NOT ECLIPSE TRADITIONAL INVESTMENT PRACTICE. Although investor intentionality is central to the mainstreaming of DEI principles within the industry, investors should consider investment opportunities for what they really are and focus on business fundamentals. Investing with a gender lens, for example, ought not be seen as a process separate from traditional investment analysis. Instead, by integrating diversity and inclusion into their investment approach, investors can receive better outcomes, including better financial returns, good governance, and effective decision making.

In conclusion, investors ought to double-down on efforts aimed at promoting a whole new generation of indigenous and diverse fund managers, while increasing diversity within their own organisations to eliminate affinity biases. Real results, however, will only be seen if this is accompanied by a general cultural change within the industry. Firstly, by acknowledging the business case for these principles, and secondly with a collective commitment to the continual monitoring of the implementation of these principles by capital allocators throughout their portfolios. Conversations such as this Roundtable hosted by AVCA are a crucial first step towards raising the profile of DEI on the agendas of private investors operating on the continent.

[1] Launch Africa, 2022. African Venture Funding Landscape

[2] IFC, Oliver Wyman and RockCreek, 2019. Moving Toward Gender Balance in Private Equity Markets

[3] AVCA, 2022. Venture Capital in Africa

[4] AVCA, 2022. Venture Capital in Africa

[5] African Development Bank, 2018. Africa Investment Forum: Putting Women At The Heart Of Financial Systems

[6] Source: African Diversity and Inclusion Centre

[7] EY Global Private Equity, 2021. Can PE Win Deals If It Doesn’t Deal With DEI?

[8] McKinsey Global Institute, 2019. The Power of Parity: Advancing Women’s Equality in Africa