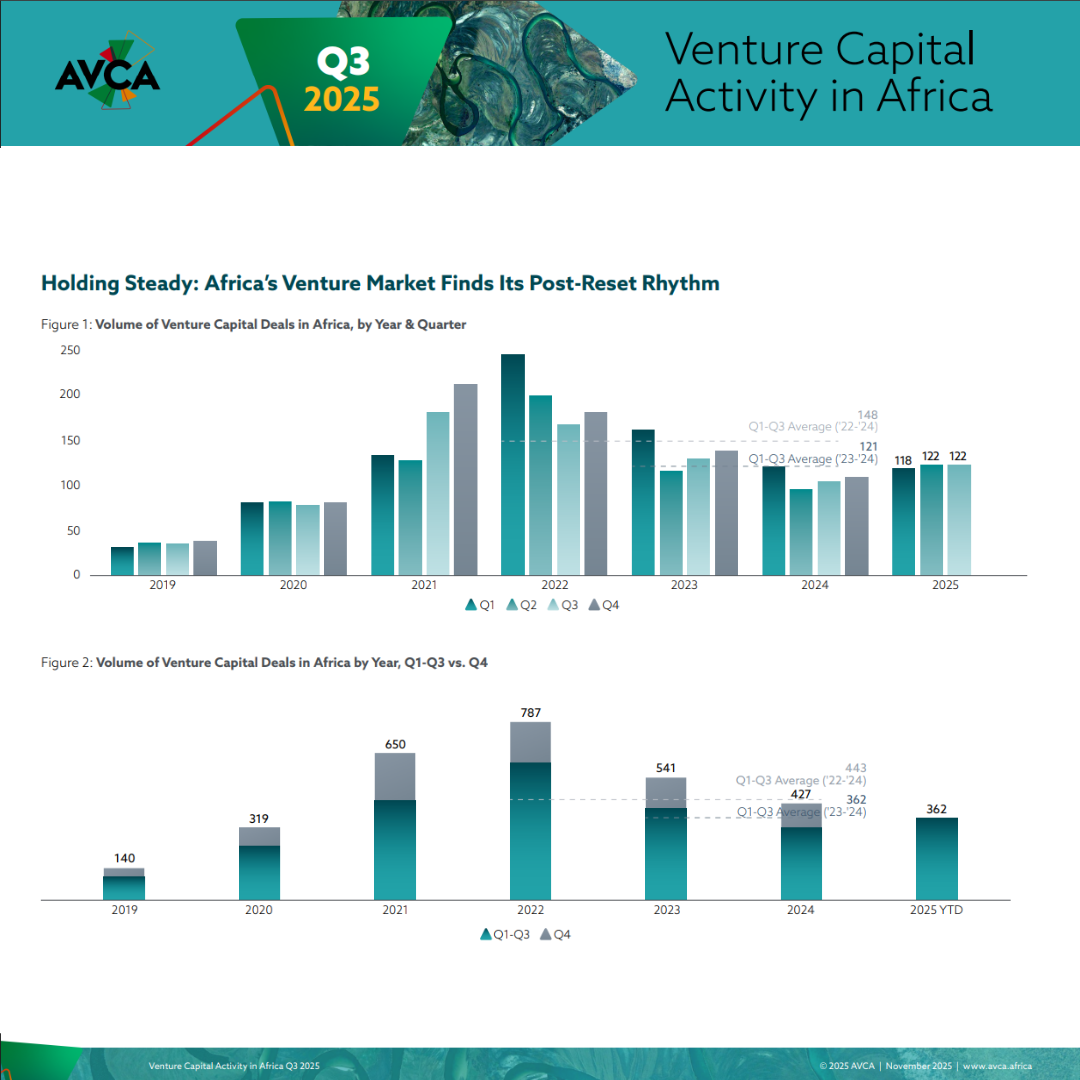

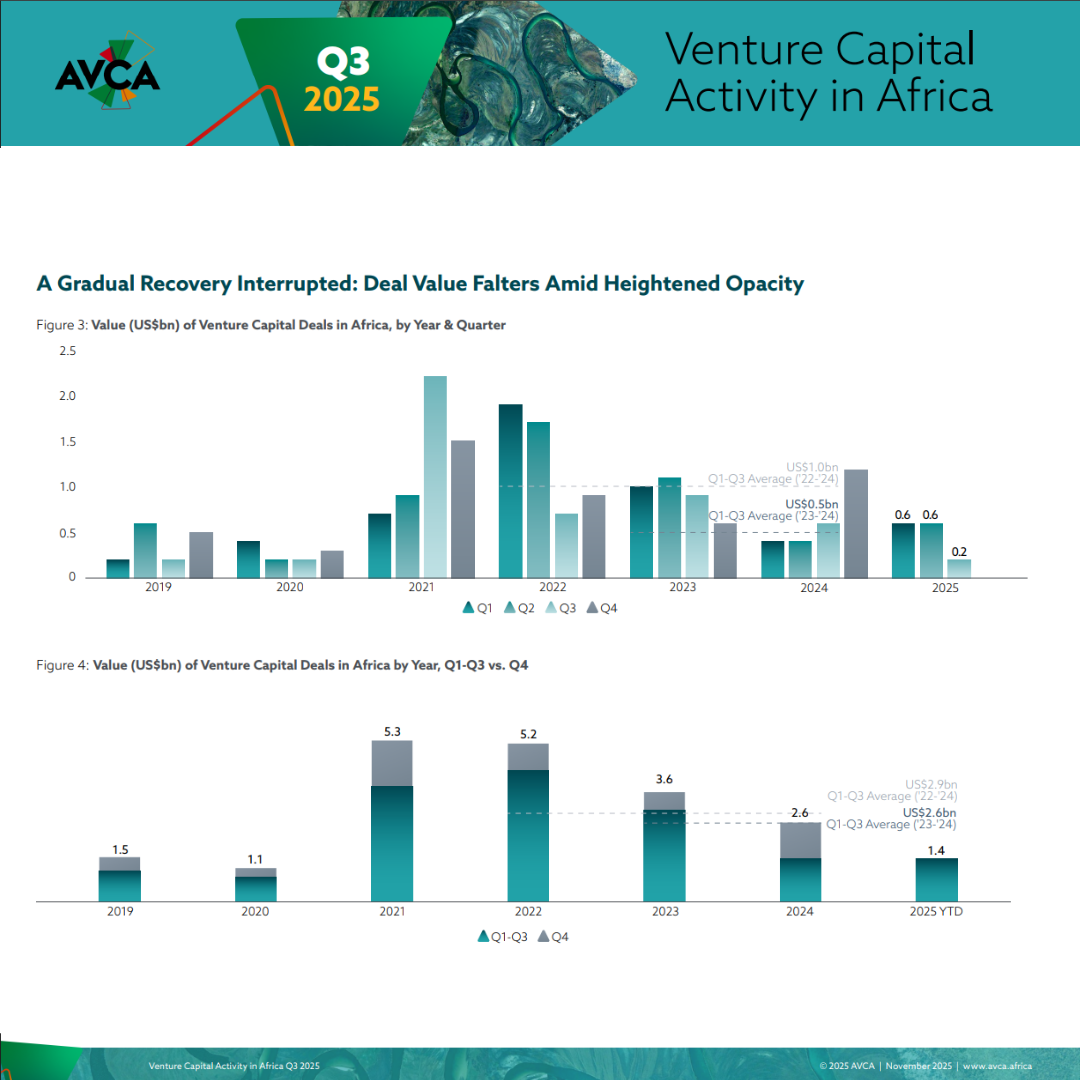

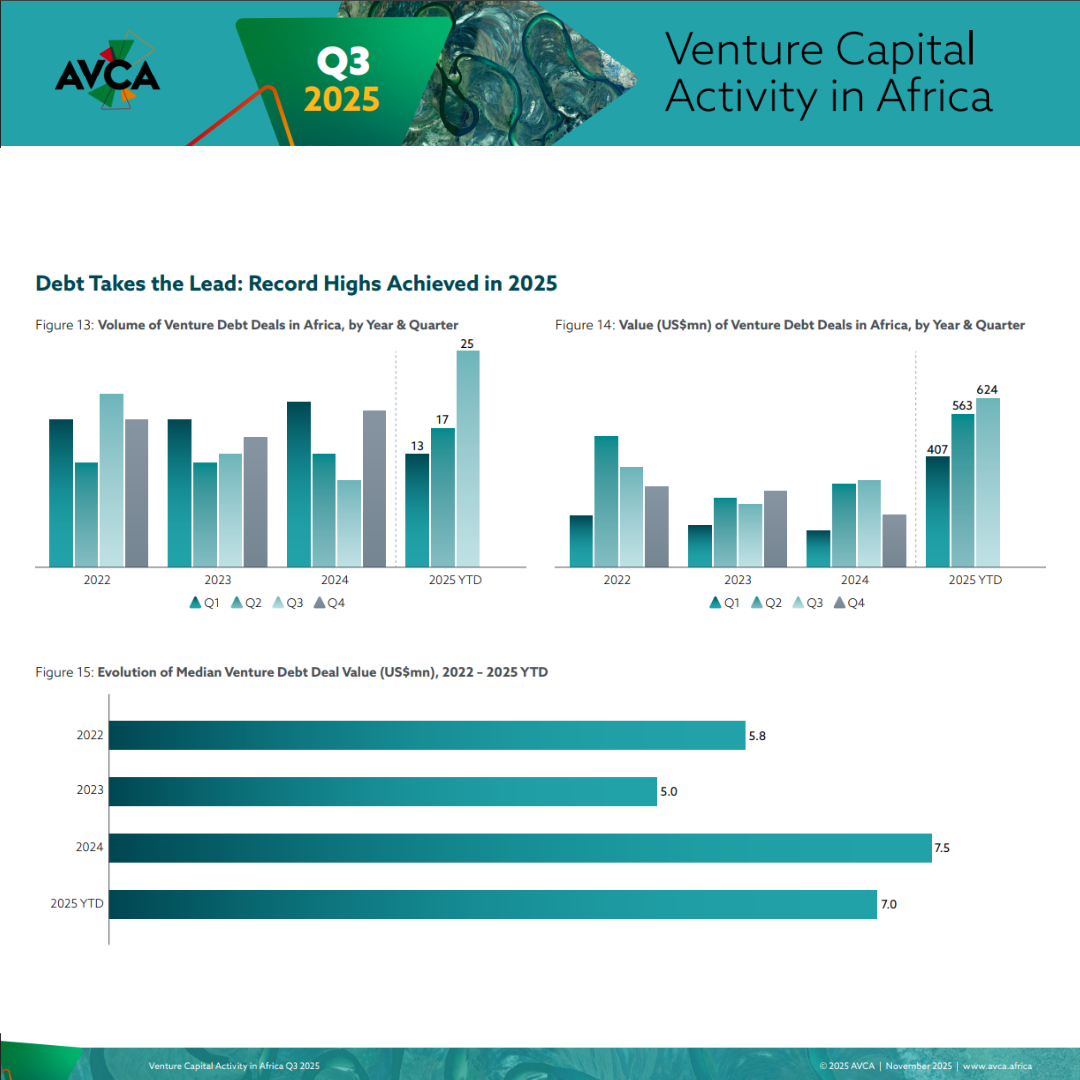

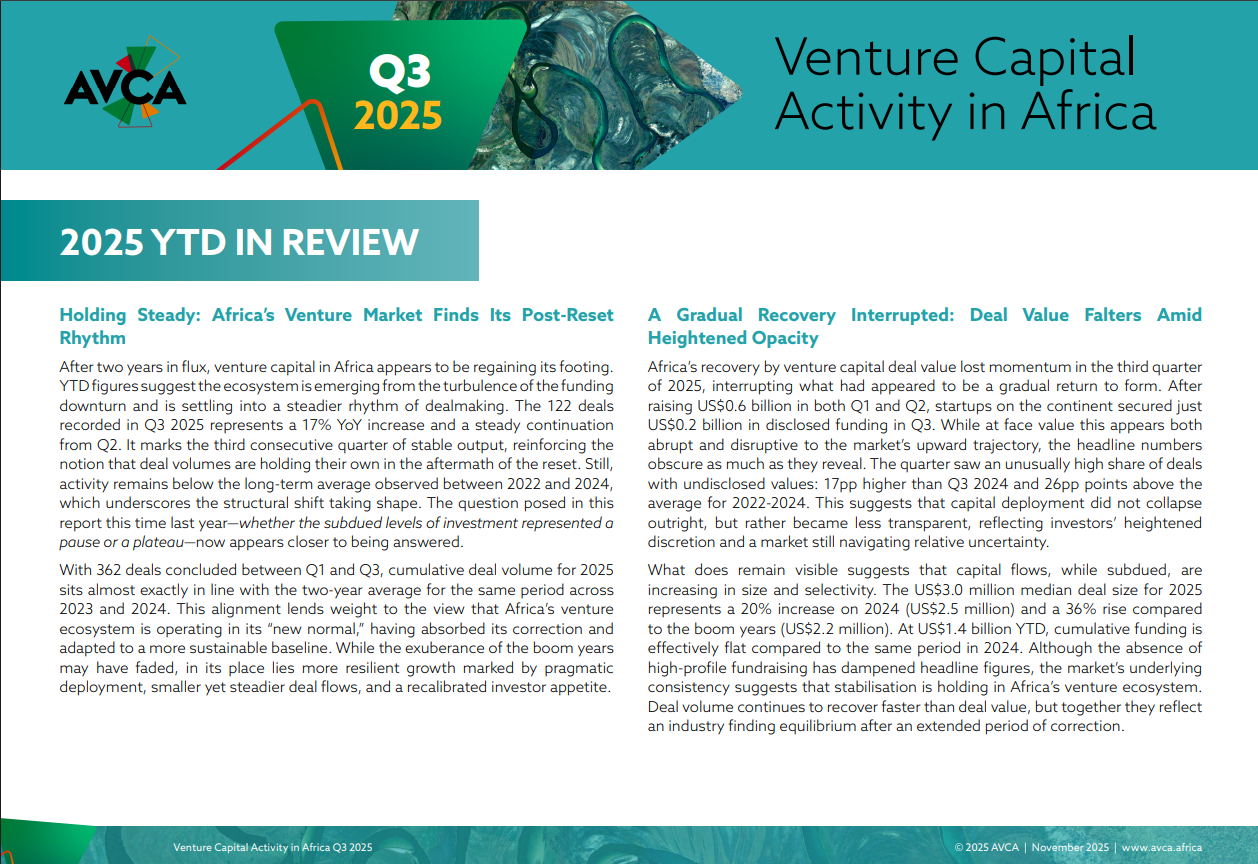

Q3 2025 Venture Capital Activity in Africa

This series provides an exclusive look at the latest trends in African venture capital, offering insights into regional dynamics, sector-specific shifts, and the key areas driving investment across the continent during the third quarter of 2025.

Read the public report

Q3 2025 Venture Capital Activity in AfricaDownload & Share With Your Network