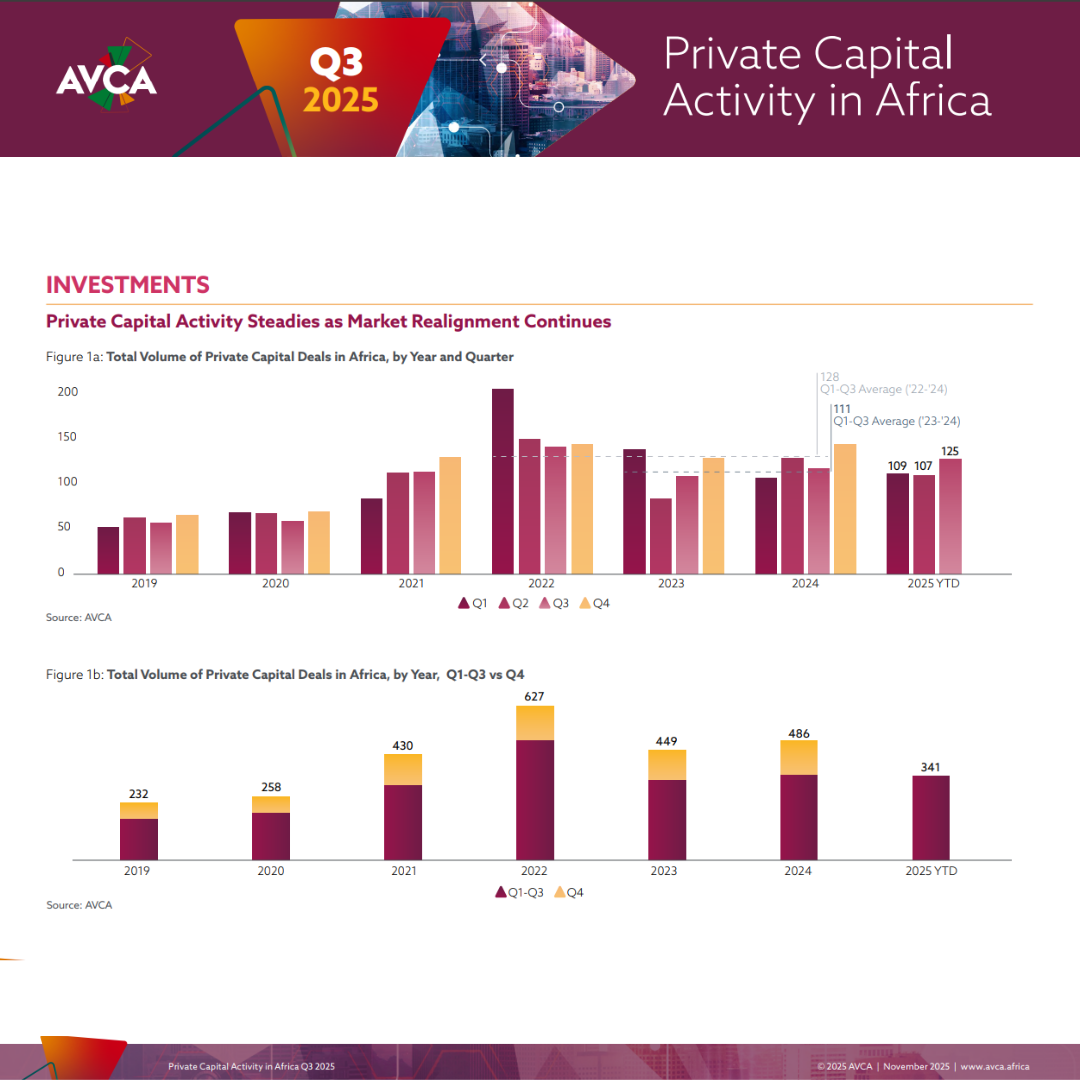

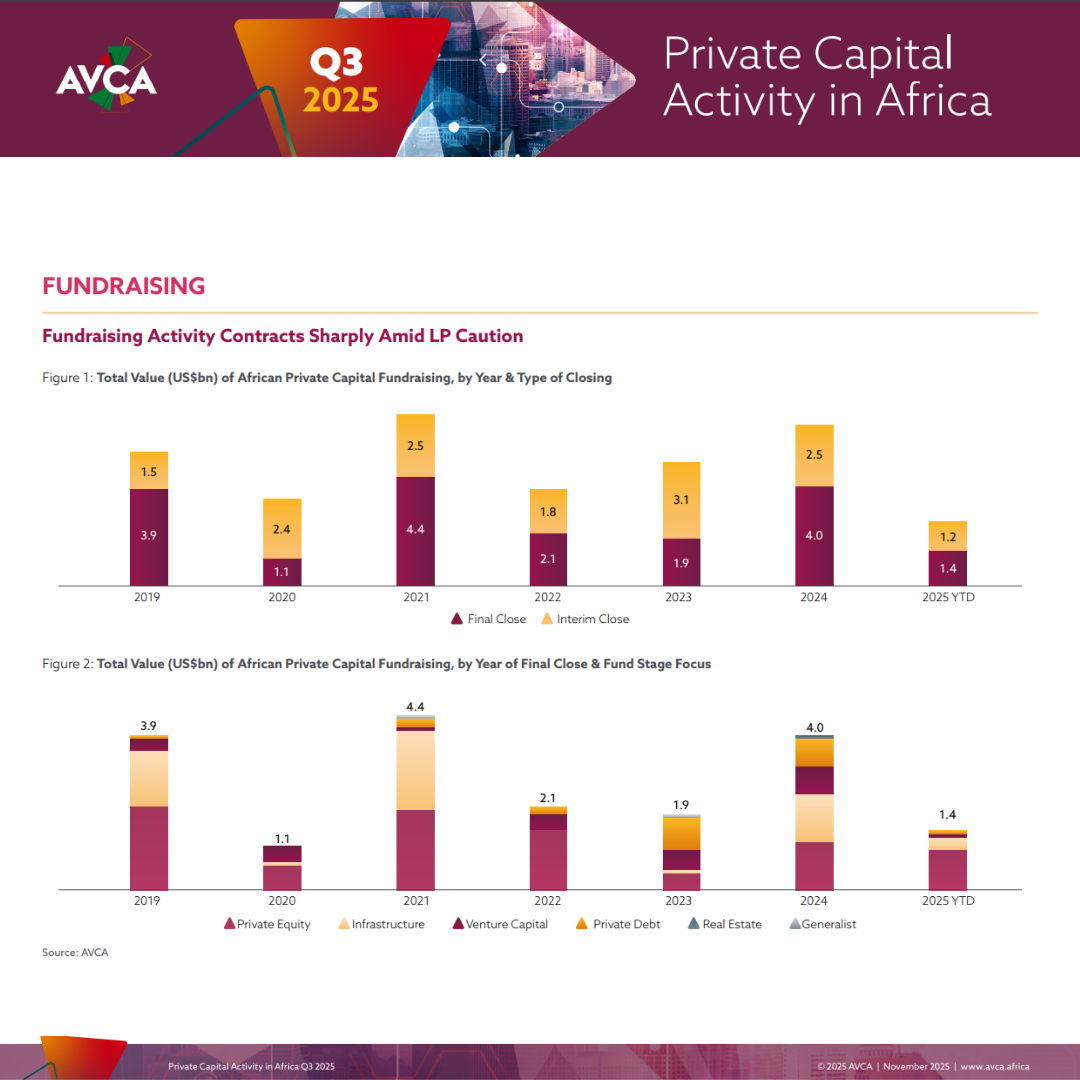

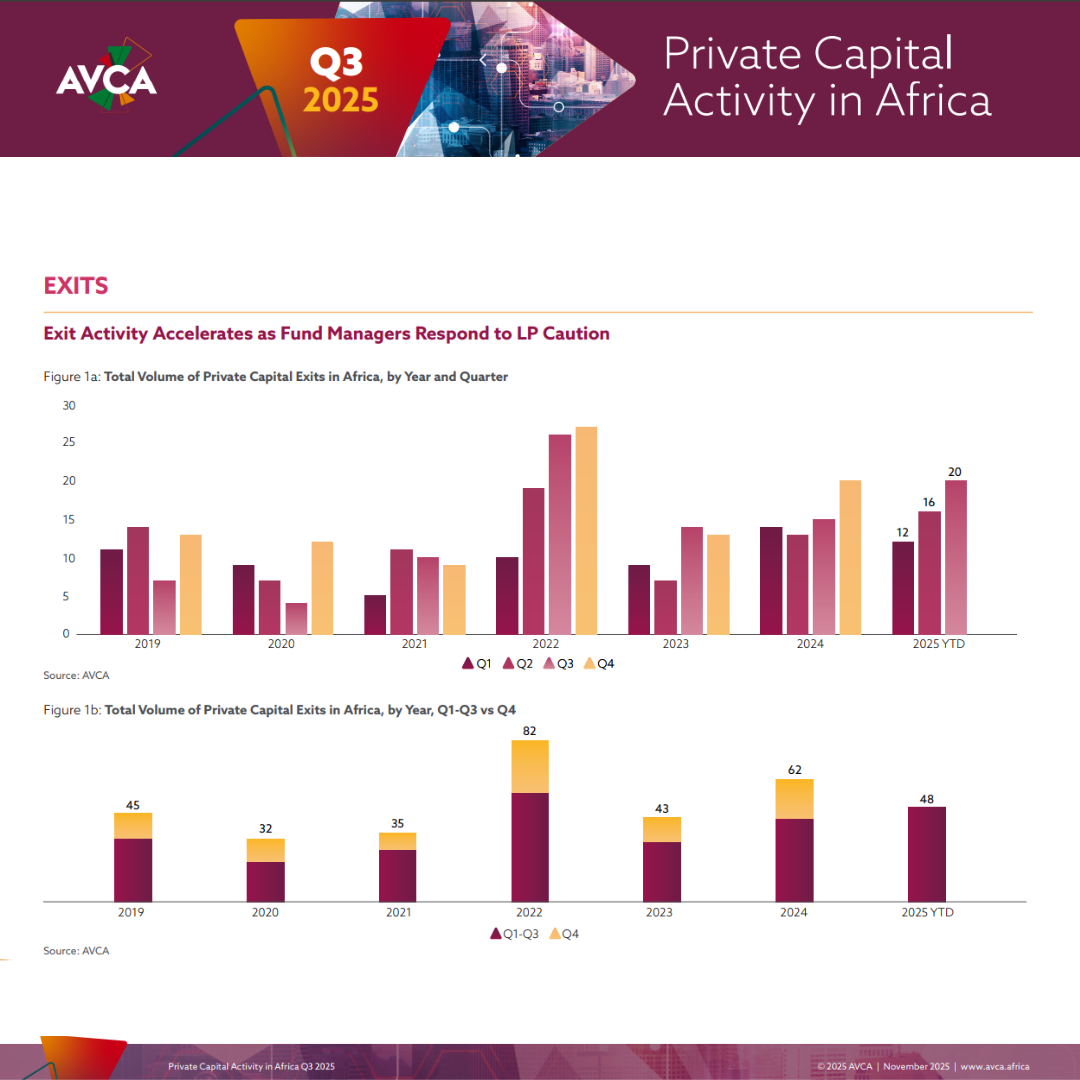

Q3 2025 Private Capital Activity in Africa

This series offers an overview of Africa's Private Capital Activity, with this report highlighting key trends in investments, exits, and fundraising observed during the third quarter of 2025.

Read the public report

Q3 2025 Private Capital Activity in AfricaDownload & Share With Your Network