Q2 2025 Private Capital Activity in Africa

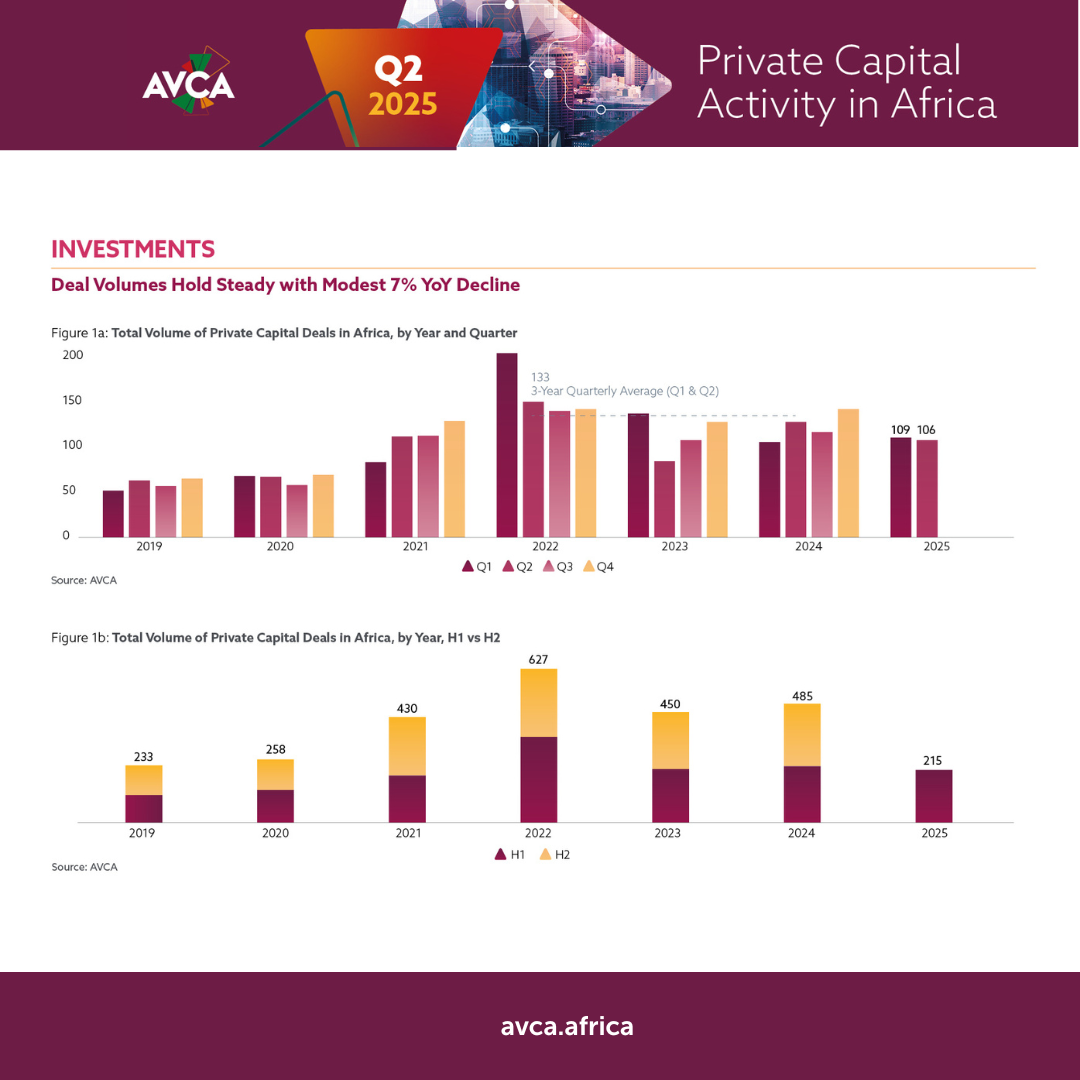

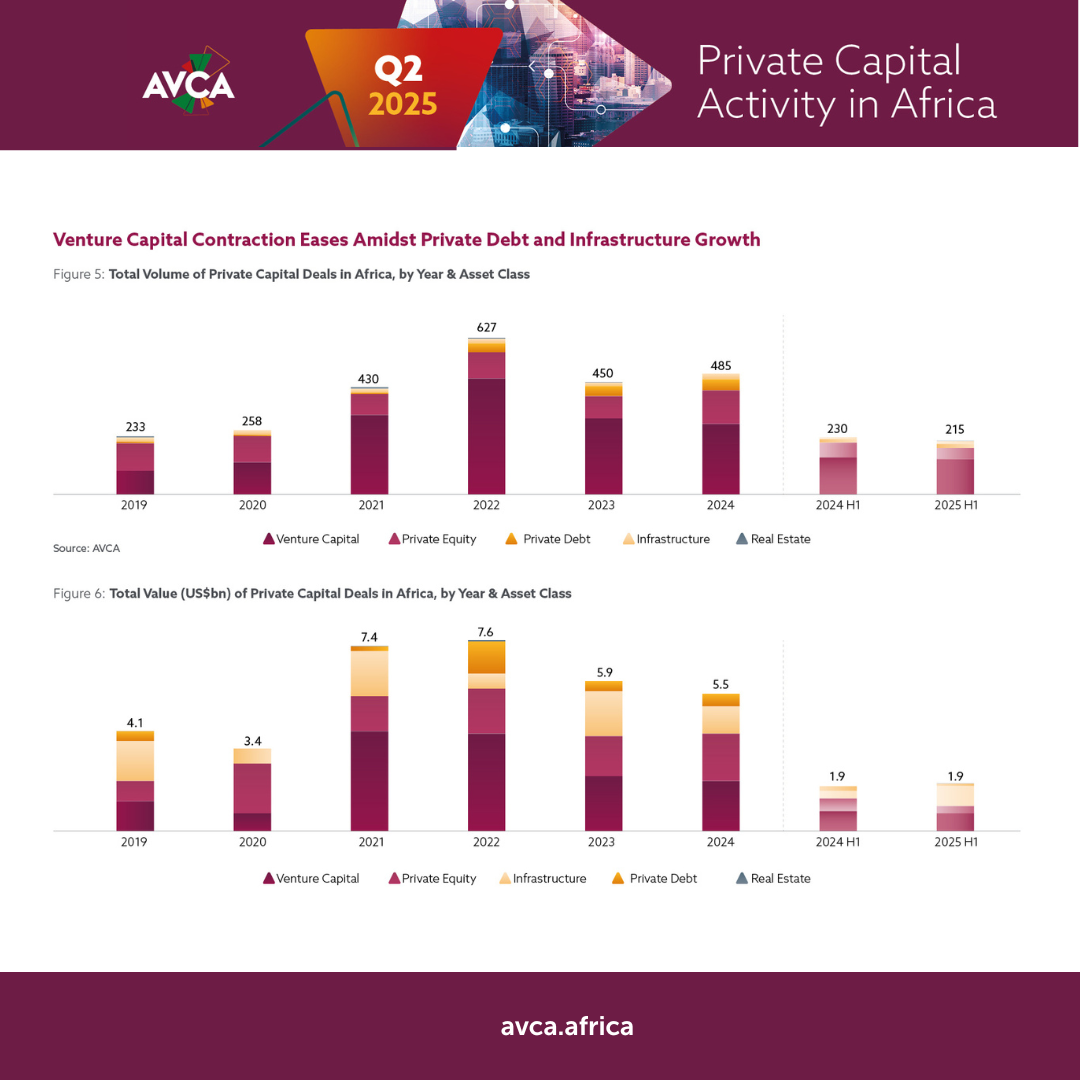

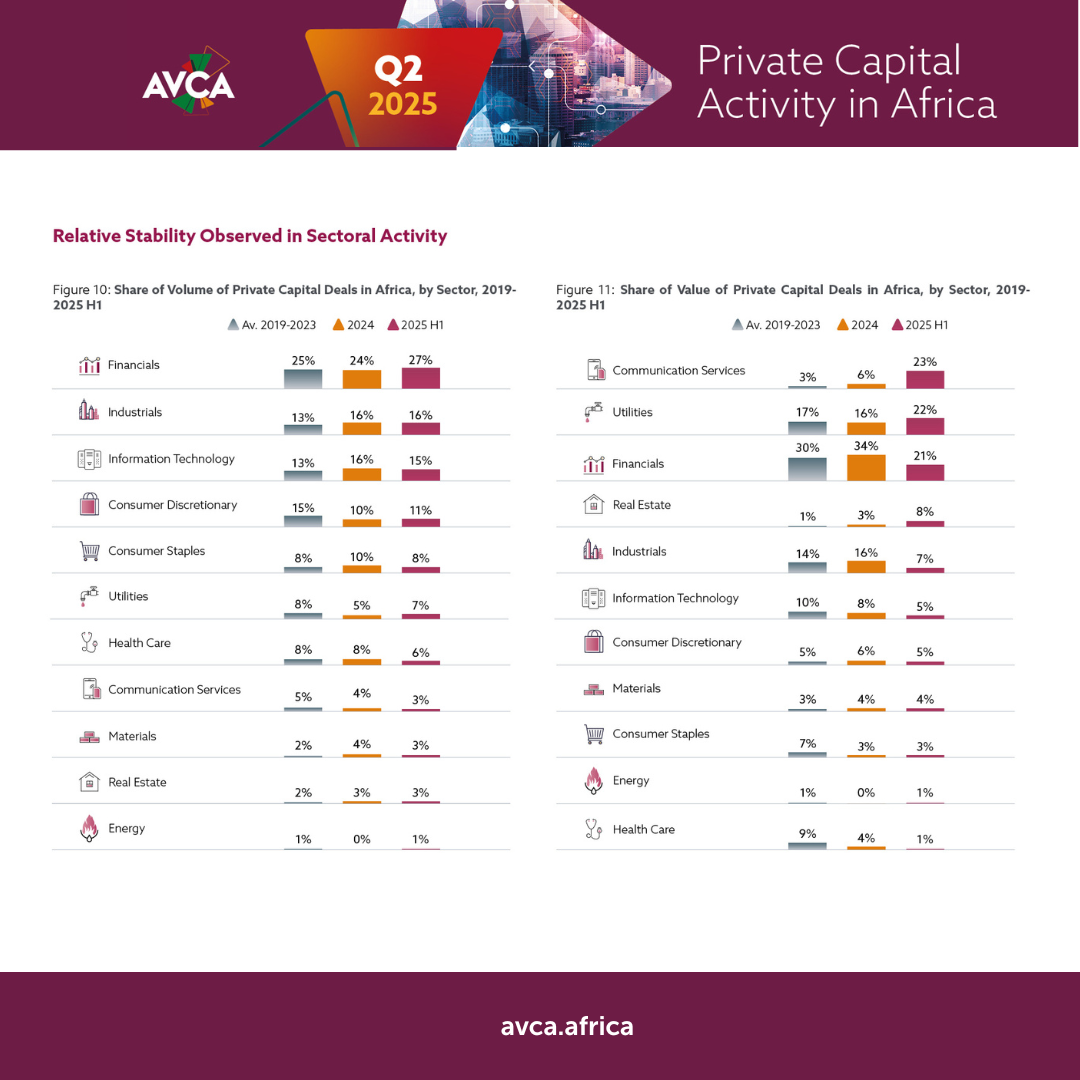

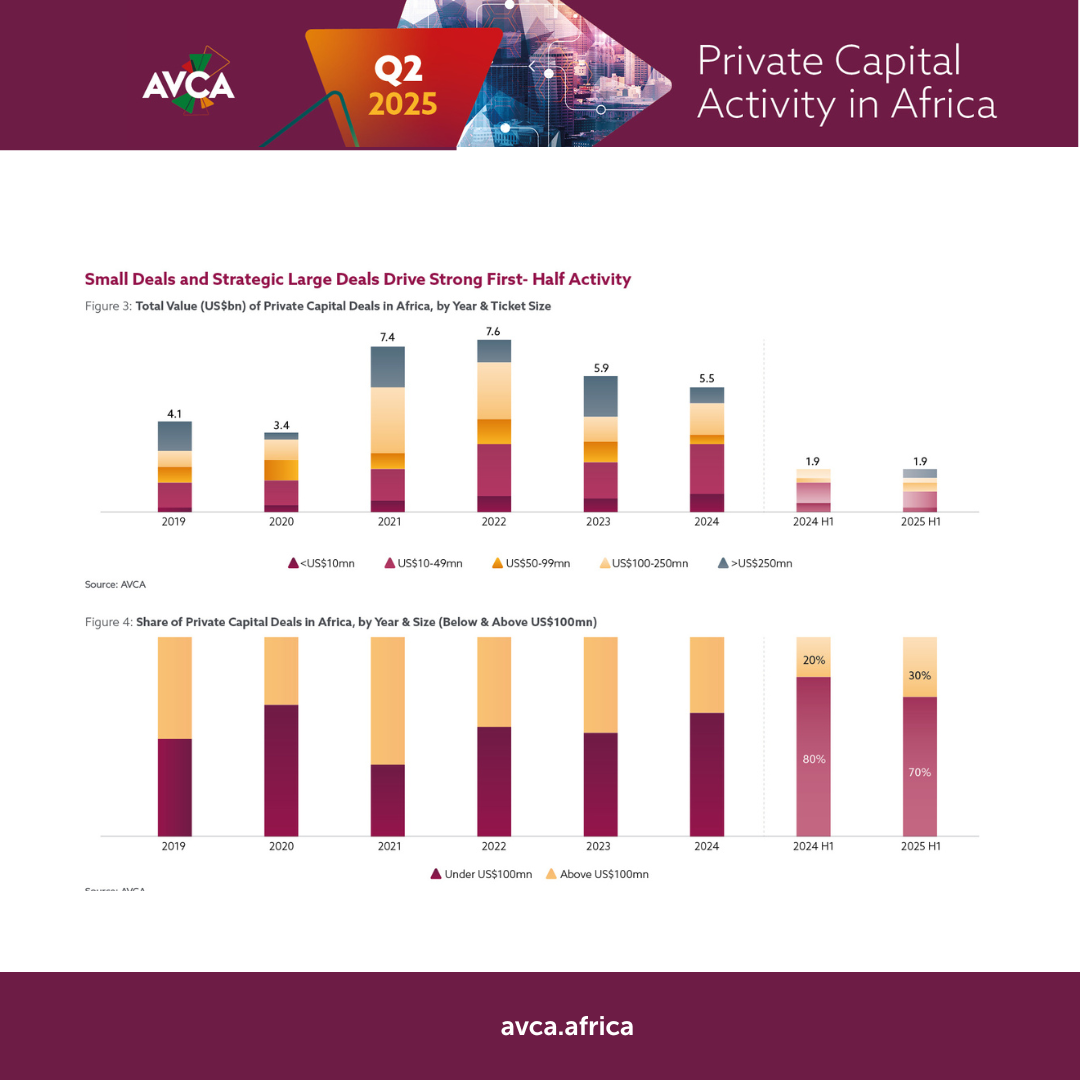

This series offers an overview of Africa's Private Capital Activity, with this report highlighting key trends in investments, exits, and fundraising observed during the first half of 2025.

Kindly complete the form to access the full report.

Read the public report

Q2 2025 Private Capital Activity in AfricaDownload & Share With Your Network

🌍Local LPs Are Stepping Up

African LPs contributed 25% of fundraising in H1 2025, up from 18% in H1 2024, reflecting a growing momentum toward homegrown capital.

Explore the full AVCA Q2 2025 African Private Capital Activity Report for full insights and sector trends: https://bit.ly/45tDgjS

🔎 H2 Outlook – Steady Momentum Ahead

African private capital is expected to maintain steady momentum, with dealmaking and fundraising showing resilience into H2 2025, according to the AVCA’s Q2 2025 African Private Capital Activity Report.

Explore the full AVCA Q2 2025 African Private Capital Activity Report for full insights and sector trends: https://bit.ly/45tDgjS