Q1 2025 Private Capital Activity in Africa

Gain exclusive insights into Africa’s latest private capital landscape, highlighting the regions, sectors, and stages shaping dealmaking across the continent.

Read the public report

Q1 2025 Private Capital Activity in AfricaKey Findings

-

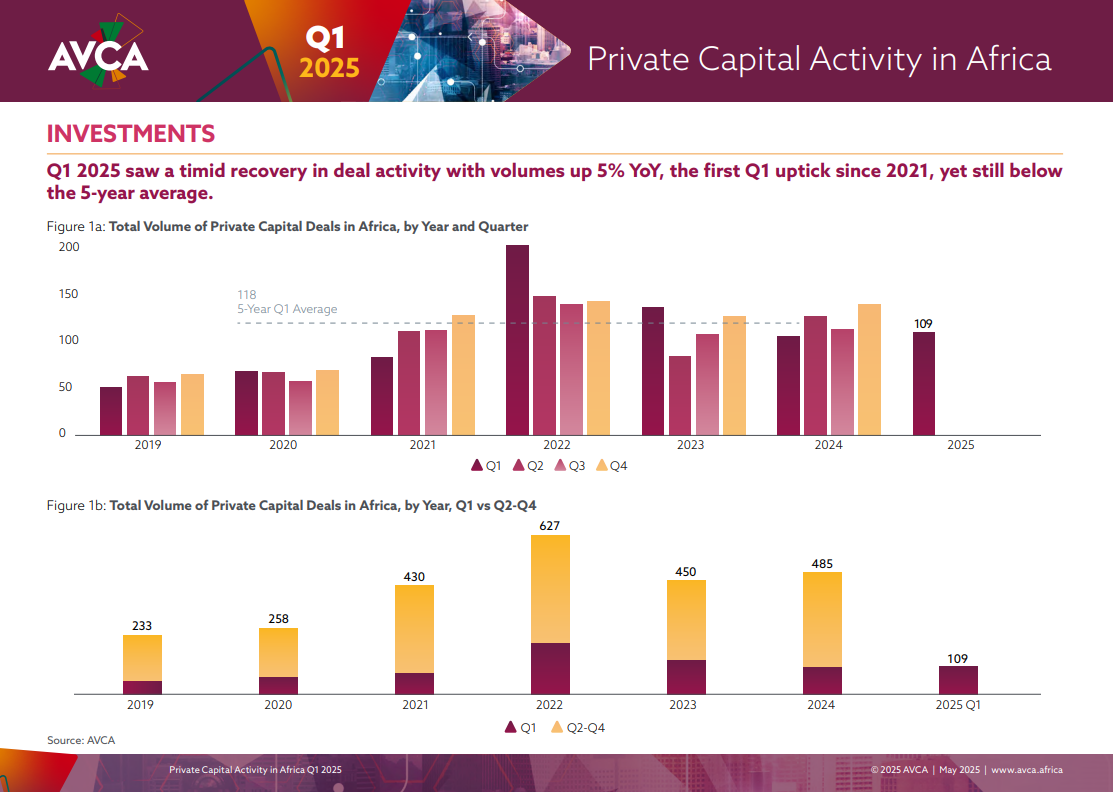

Cautious Recovery in Investments: Private capital activity in Q1 2025 totalled US$1bn invested across 109 deals, marking a cautious recovery as volumes rose 5% and values inched up 2% YoY.

-

Venture Capital and Private Equity Lift amidst Private Debt Lull: Sustained interest in Private Equity and modest 9% YoY rise in early-stage Venture Capital deal volume supported Q1 2025 activity while Private Debt remained muted.

-

Southern Africa Bucks Trends: Amidst a regional slowdown, Southern Africa defied trends with a 2.1x YoY jump in deal value, capturing an outsized 67% share of total capital deployed.

-

Fundraising Momentum Picks Up: Final close fundraising value rose 14% YoY, reflecting steady investor commitment despite smaller average fund sizes.

-

Secondaries Anchor Exits: Private Equity-led exits steadied Q1 2025 exit activity amidst drop in Trade sales.