PE Exits in Africa 2017

14th Annual AVCA Conference, Abidjan, Ivory Coast

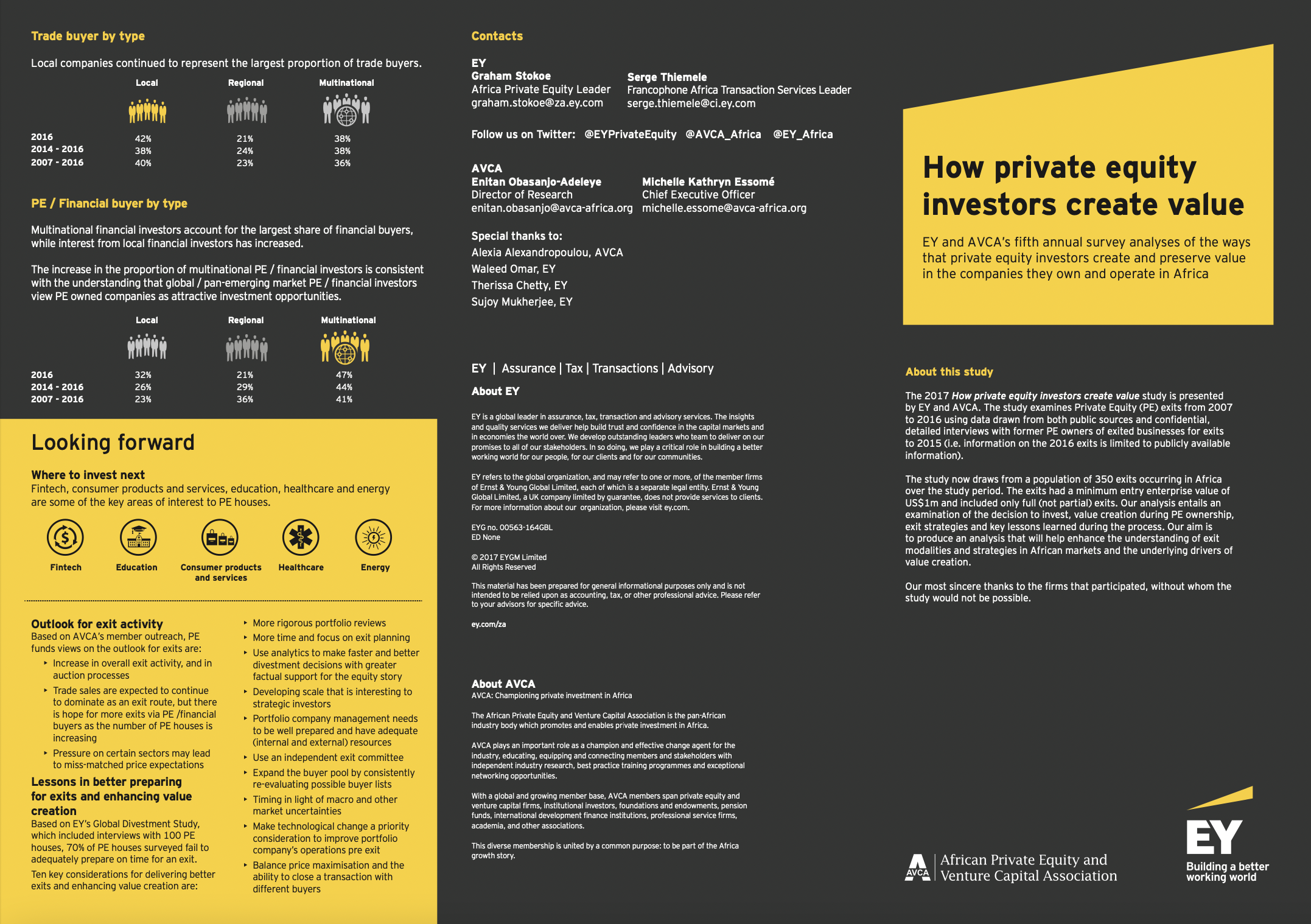

The 2017 How private equity investors create value study is presented by EY and AVCA. The study examines Private Equity (PE) exits from 2007 to 2016 using data drawn from both public sources and confidential, detailed interviews with former PE owners of exited businesses for exits to 2015 (i.e. information on the 2016 exits is limited to publicly available information).

Read the public report

PE Exits in Africa 2017Key findings:

-

PE exits hit records highs in 2016: The number of exits achieved by PE houses in Africa has showed an upward trend with a record number of exits in 2016.

-

Top countries for exits, 2007-2016: Over the last ten years, the top 5 countries accounted for 70% of PE exits.

-

PE exits by industry: Financial services, industrials, consumer goods and services continued to attract the highest number of PE exits between 2007 and 2016 and during the last 3 years.

-

The bulk of PE exits continue to be concentrated in South Africa.

-

An increase in the average holding period confirms our view that PE houses are inclined to hold their investments in portfolio companies for longer than developed markets. The average in 2016 is also distorted by a greater number of exits of infrastructure investments with longer hold periods.

-

Exits in North Africa increased to its highest levels in 2016 and exits in West Africa also recovered in 2016.

-

A significant uptick in sales to PE and other financial buyers occurred in 2016 indicating a maturing and more competitive African PE industry. A marked decline in MBOs and private sales occurred in 2016.

-

Exits to trade buyers still represent the most common exit route.