Gender Diversity in African Private Capital

This report will be the first instalment in a new series of original research examining gender dynamics across Africa’s private capital ecosystem, which examines gender representation across two levels:

- The fund level (investment teams and decision-makers)

- The portfolio level (founders and senior executives backed by private capital).

The findings offer a 360° view of where progress is being made, where gaps persist, and how intentional leadership can drive meaningful change.

We look forward to hearing your thoughts!

Key Findings:

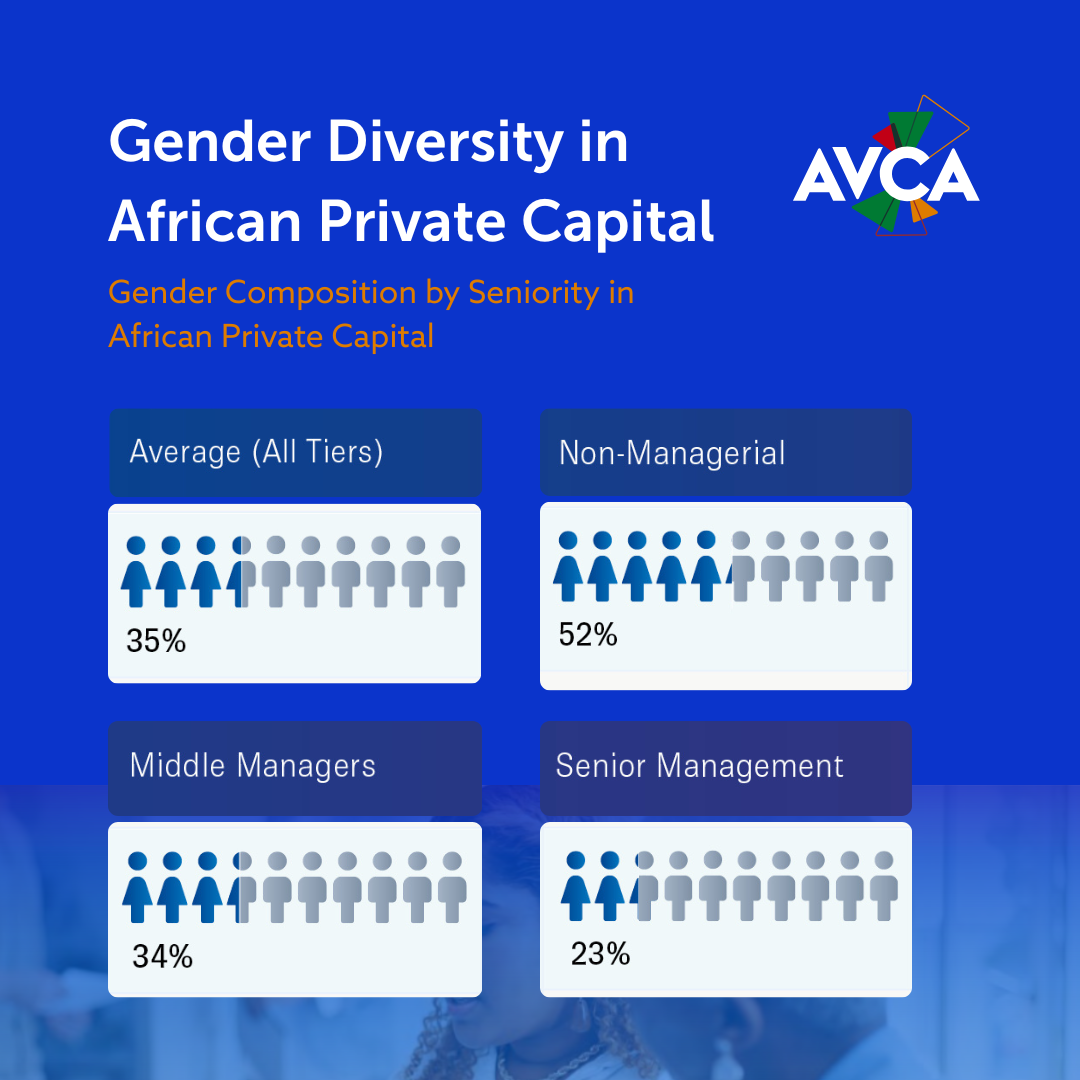

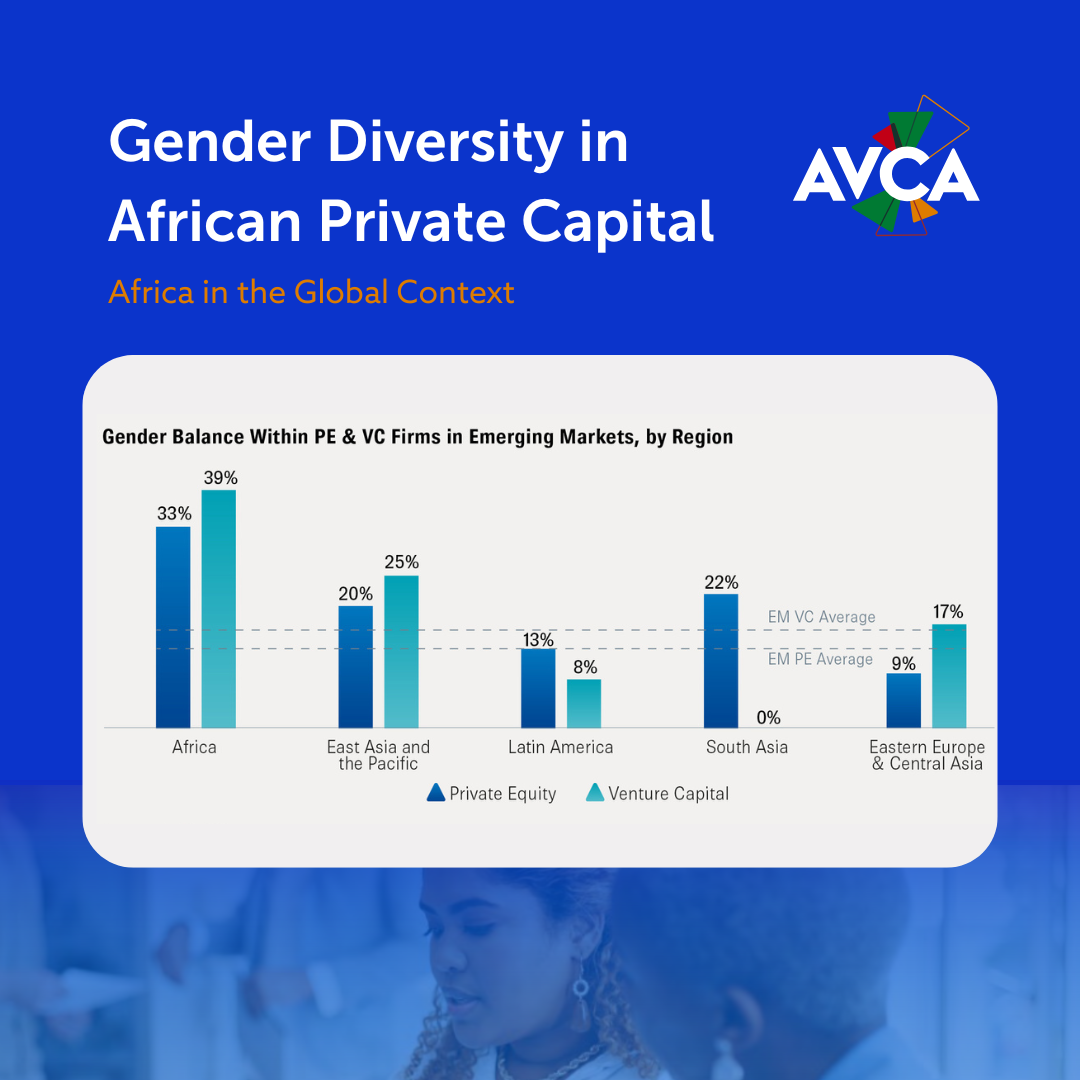

- Africa’s private capital firms outperform global benchmarks in gender representation at the fund level: women make up 38% of investment teams and 33% of investment committees.

- Gender diversity declines sharply as firms scale: smaller and lower-AUM managers are far more gender-balanced, while large, capital-concentrated firms remain male-dominated in decision-making roles.

- Despite progress at GP level, women remain underrepresented in portfolio leadership: only 7% of portfolio companies are female-founded and 12% female-led, indicating limited translation of fund-level diversity into capital allocation outcomes.

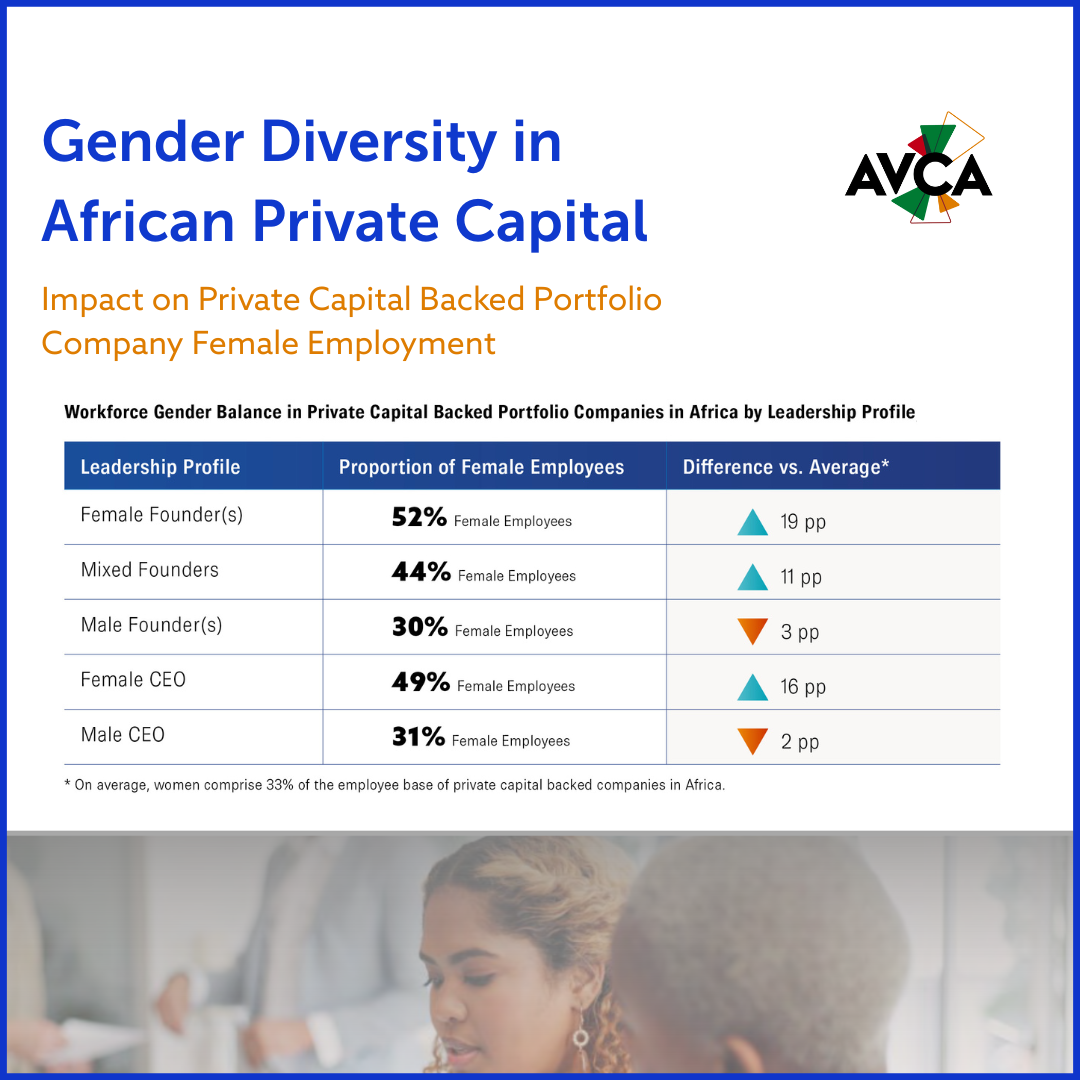

- Investment committee (IC) composition matters: firms with female-dominated or gender-balanced ICs back significantly more women-led companies and more gender-diverse workforces than male-dominated peers.

- Gender-diverse leadership correlates with performance: female-led portfolio companies employ more women and record materially stronger revenue growth than male-led counterparts.

Download our shareable graphics and share the key findings with your network.

Share On:

We look forward to hearing your thoughts!

More AVCA Research

10 February 2026

2025 Venture Capital in Africa Report

The seventh annual Venture Capital Activity in Africa report provides an overview of the current events shaping Africa's startup investment landscape and an in-depth analysis of entrepreneurial and venture activity seen on the continent across 2025.

12 January 2026

Gender Diversity in African Private Capital

This report will be the first instalment in a new series of original research examining gender dynamics across Africa’s private capital ecosystem, which examines gender representation across two levels: the fund level and the portfolio level.

13 November 2025

Q3 2025 Venture Capital Activity in Africa

This series provides an exclusive look at the latest trends in African venture capital, offering insights into regional dynamics, sector-specific shifts, and the key areas driving investment across the continent.

13 November 2025

2025 Q3 Private Capital Activity in Africa

This series offers an overview of Africa's Private Capital Activity, with this report highlighting key trends in investments, exits, and fundraising. Africa’s private capital landscape is transitioning, with +17% in deal volume and +4% in exits YoY.