AVCA Spotlight on Southern Africa Private Equity

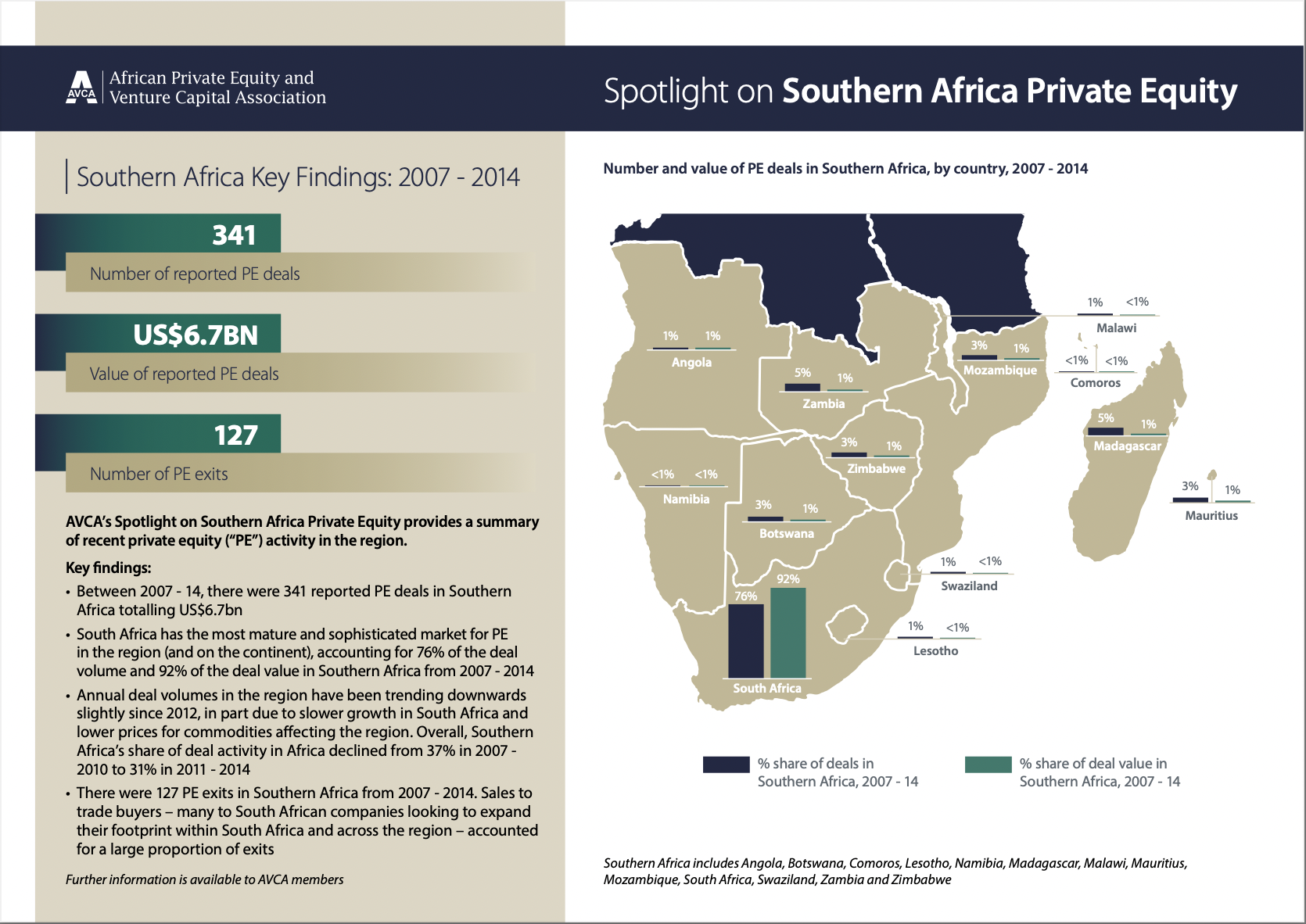

Tthe Spotlight on Southern Africa Private Equity provides a summary of recent private equity transactions, exits and fundraising activity in the region. Our findings reveal that 341 PE deals were completed in the region between 2007 and 2014 with a combined value of US$6.7bn.

Read the public report

AVCA Spotlight on Southern Africa Private EquityKey findings:

-

Between 2007 - 14, there were 341 reported PE deals in Southern Africa totalling US$6.7bn

-

South Africa has the most mature and sophisticated market for PE

in the region (and on the continent), accounting for 76% of the deal volume and 92% of the deal value in Southern Africa from 2007 - 2014 -

Annual deal volumes in the region have been trending downwards slightly since 2012, in part due to slower growth in South Africa and lower prices for commodities affecting the region. Overall, Southern Africa’s share of deal activity in Africa declined from 37% in 2007 - 2010 to 31% in 2011 - 2014

-

There were 127 PE exits in Southern Africa from 2007 - 2014. Sales to trade buyers – many to South African companies looking to expand their footprint within South Africa and across the region – accounted for a large proportion of exits