Pension Funds and Private Capital in Ghana Report

This report examines how Ghana’s pension funds can evolve from passive capital holders into active participants in Africa’s private capital ecosystem.

As the industry matures, the imperative is no longer whether to diversify, but how swiftly and effectively pension assets can be deployed into alternative investments.

For questions or comments on this publication, please contact research@avca.africa.

We look forward to hearing your thoughts!

Key findings:

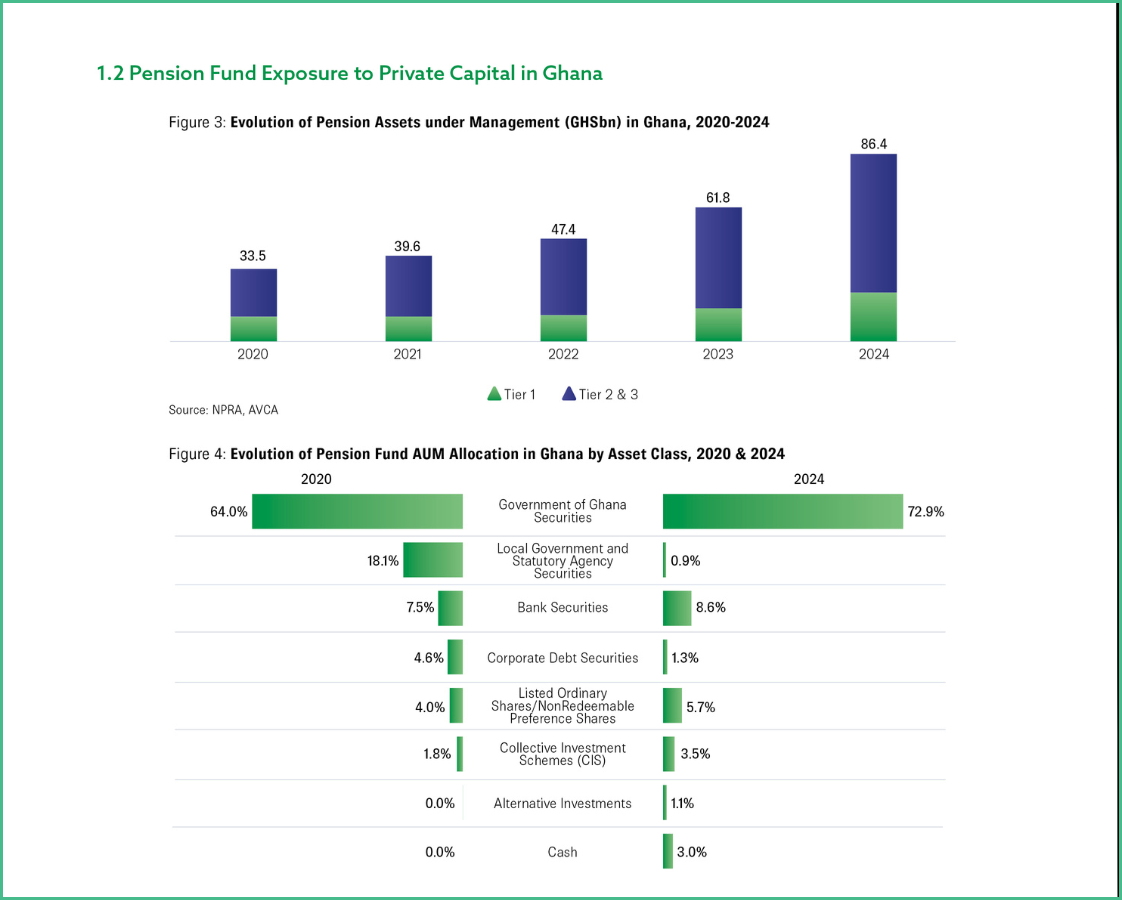

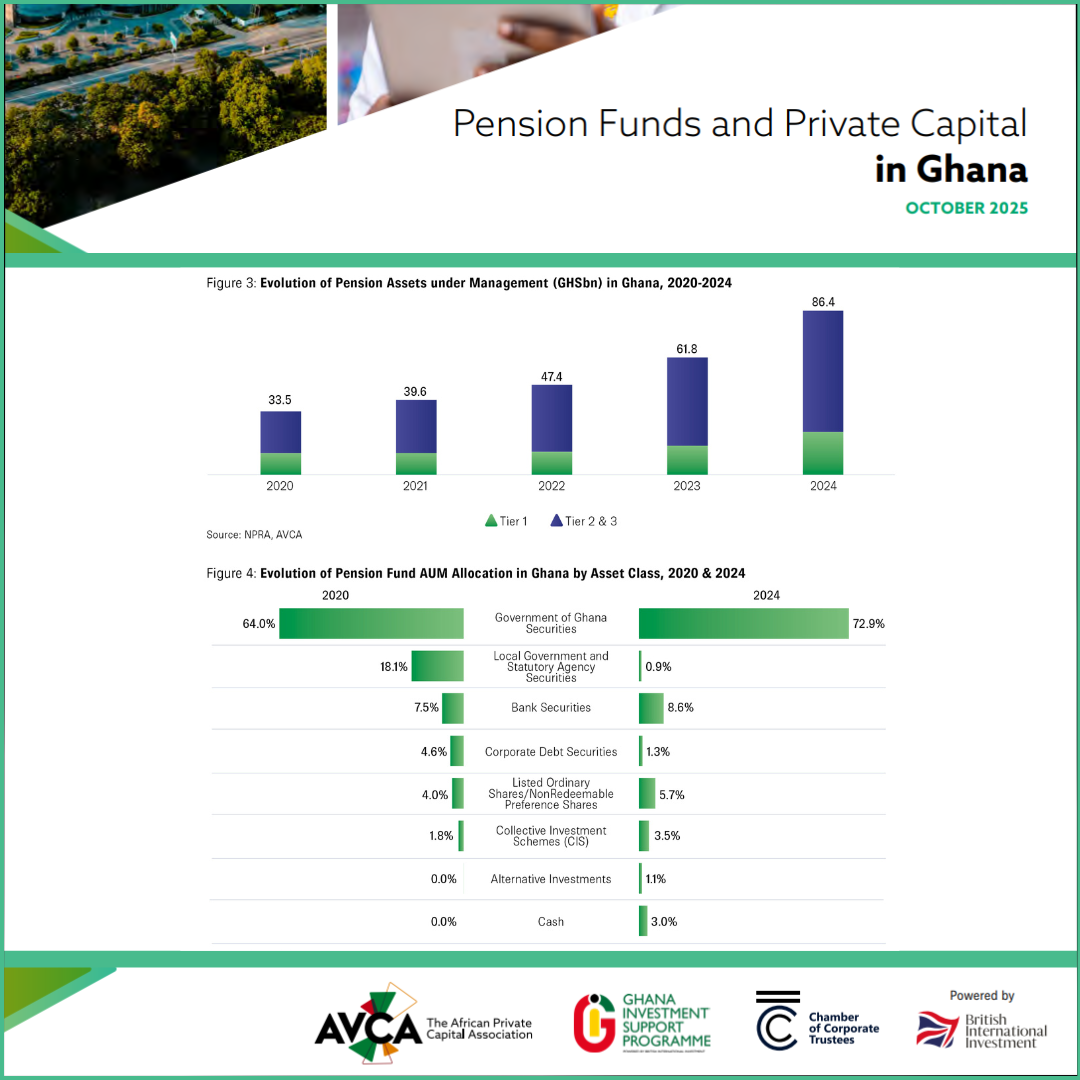

- GHS86.4bn (US$5.9bn) of total pension assets in 2024, positioning them as a major source of long-term domestic capital.

- Private pension exposure to alternative investments remained low at just 1.1% of AUM, but has progressed from 0.03% in 2020.

- Of that, only 0.5% of AUM was allocated to private capital asset classes, including private equity, venture capital, real estate, infrastructure, and private debt.

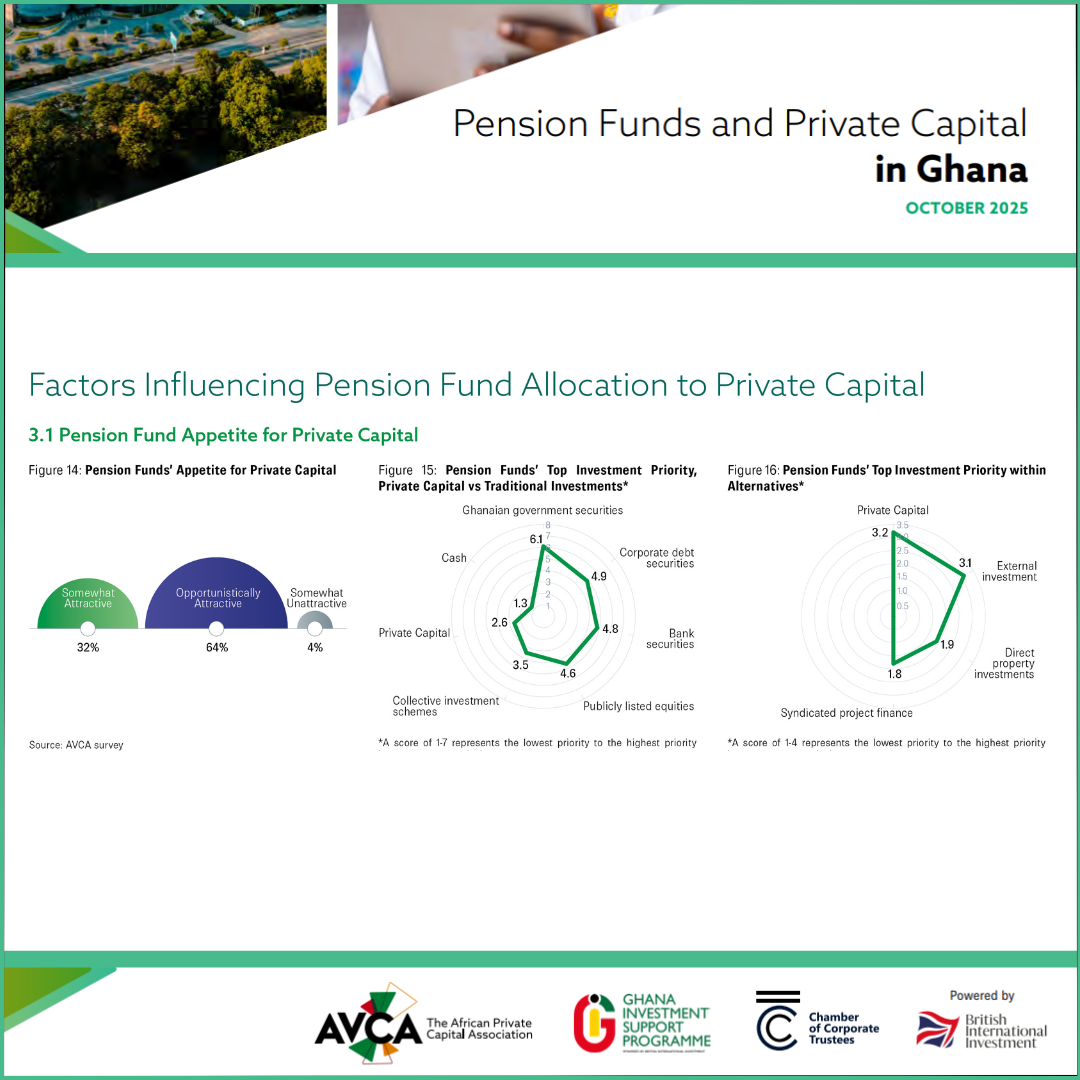

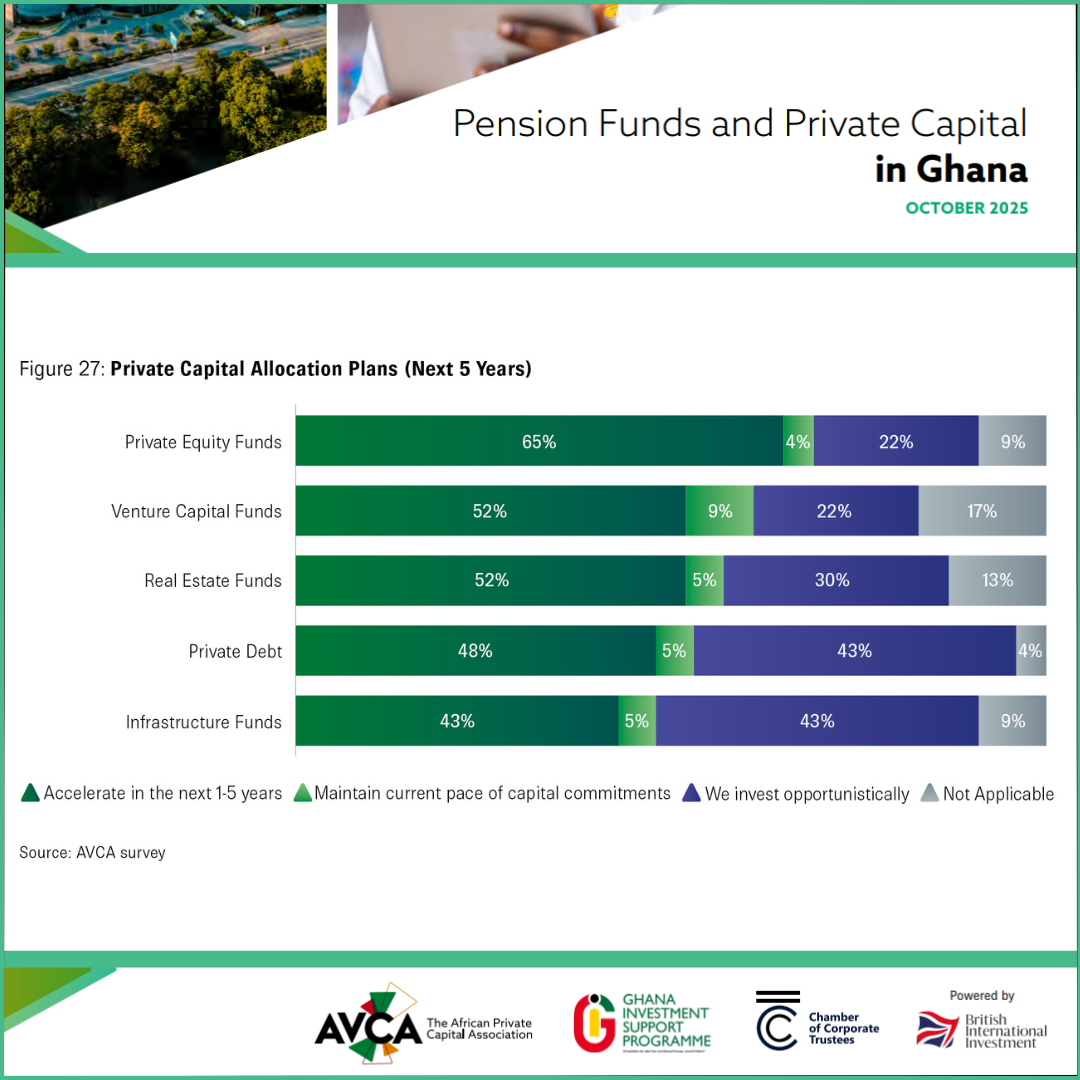

- Momentum is building: 57% of pension funds have some private capital exposure, and a further 33% are seeking to make their first allocation.

- If fully utilised, the 25% permissible allocation could unlock over US$1bn for private capital investment.

- Despite a more favourable outlook among pension funds toward private capital, key barriers still temper deeper engagement. These include ongoing regulatory hurdles, market limitations, structural challenges and Manager-related constraints.

- This report presents four pillars to increase pension fund allocations. If implemented, these stand to transform Ghana into a regional private capital hub.

Download our shareable graphics and share the key findings with your network.

Social Media Caption Template:

💡 NEW AVCA Research: Pension Funds and Private Capital in Ghana

Ghana’s pension industry has exhibited strong growth, tripling in size over the last 5 years. Despite this momentum and increasing interest in private capital, conservative allocations and barriers to pension fund participation remain.

📄 Read the full report: https://bit.ly/476WzAo

#AVCAResearch #PrivateCapital #PensionFunds #Ghana #Investment #AfricaFinance