2025 Venture Capital in Africa Report

The seventh annual Venture Capital Activity in Africa report provides an overview of the current events shaping Africa's startup investment landscape and an in-depth analysis of entrepreneurial and venture activity seen on the continent.

Question for the Research Team?

For questions or comments on this publication, please contact research@avca.africa.

AVCA Members

Download the ReportNon-AVCA Members

Download the ReportKey Findings:

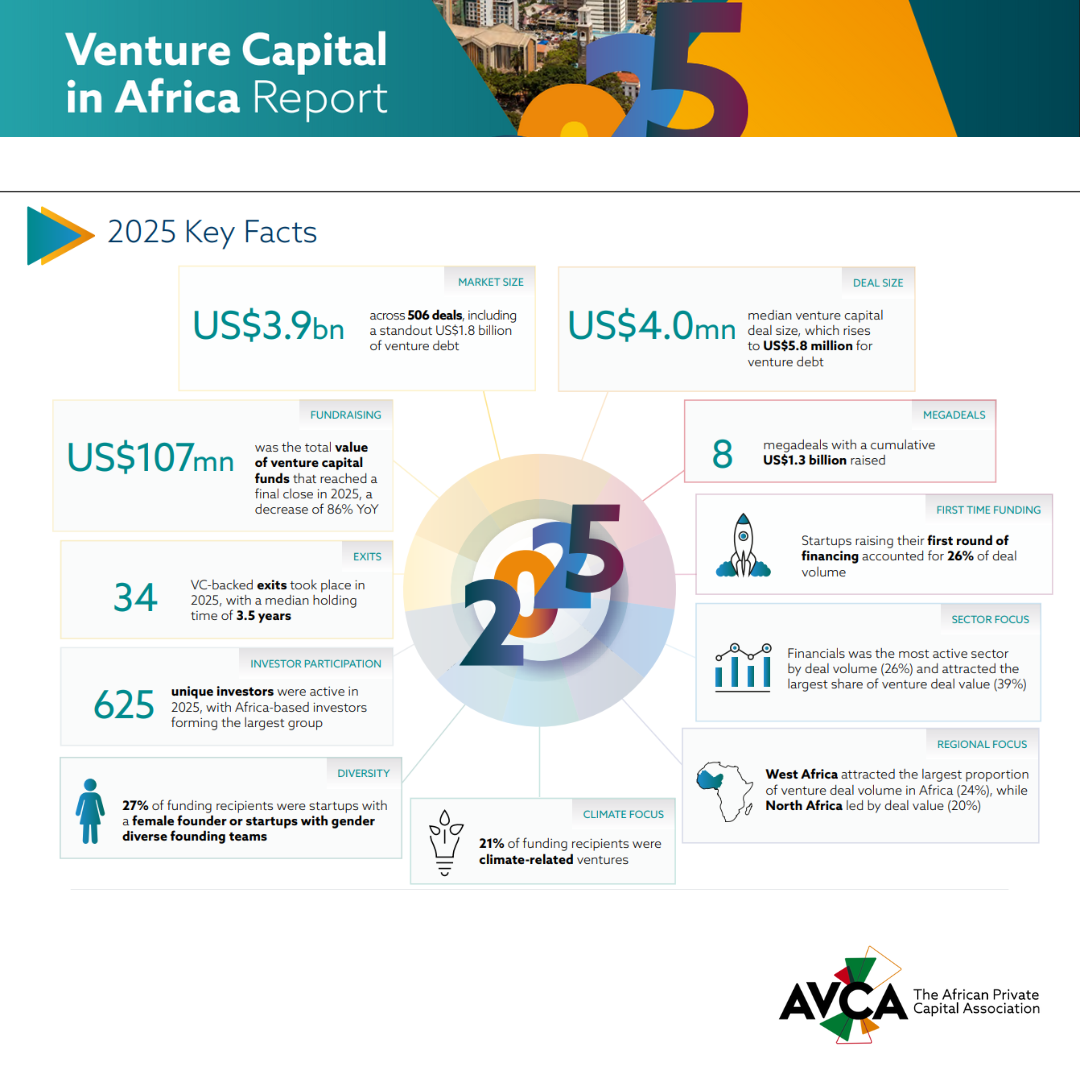

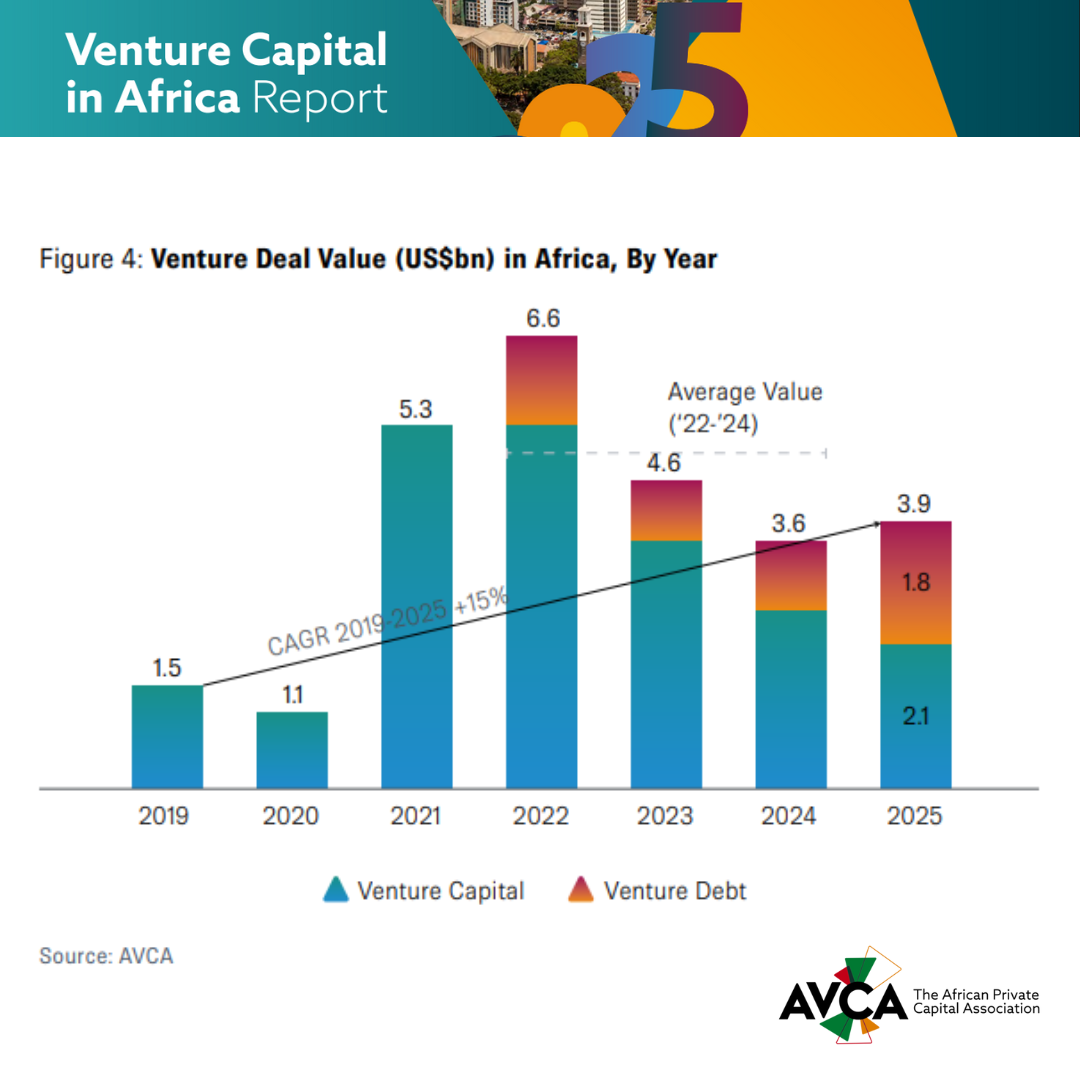

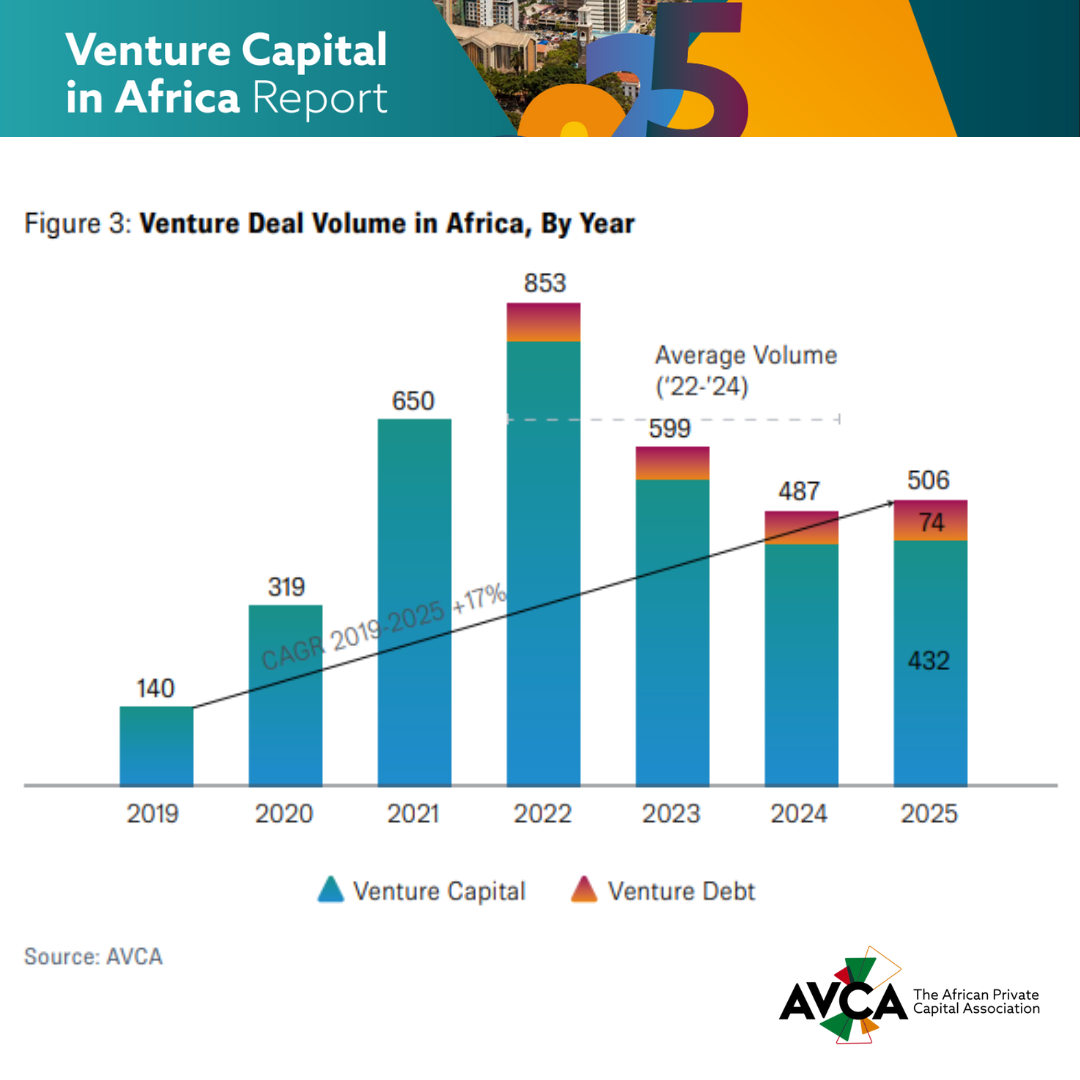

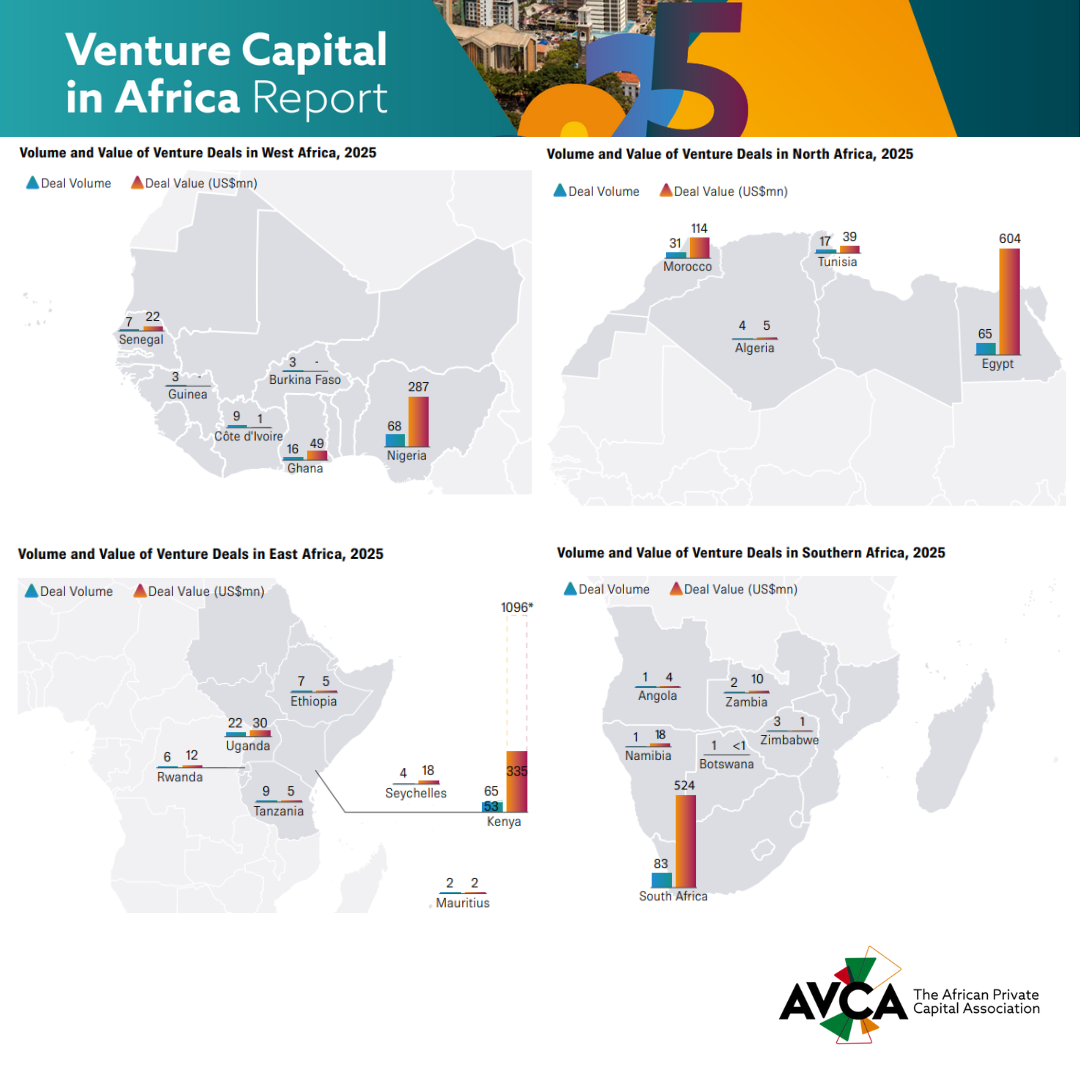

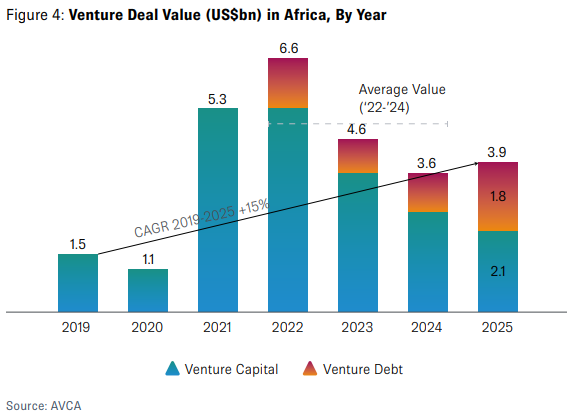

- Stability Amid Global Contraction: Africa closed 506 venture deals across equity and debt (+4% YoY), totalling US$3.9bn in deal value and becoming the only major region where deal volumes did not decline YoY.

-

Venture Debt Took the Spotlight: Venture debt was the standout feature of 2025, with 74 deals completed (+23% YoY) and total value surging 91% to US$1.8bn.

- Climate Rises Its Share: US$1.5bn (40% of deal value in 2025) went to climate-related ventures, up from US$0.9bn (24% of deal value in 2024).

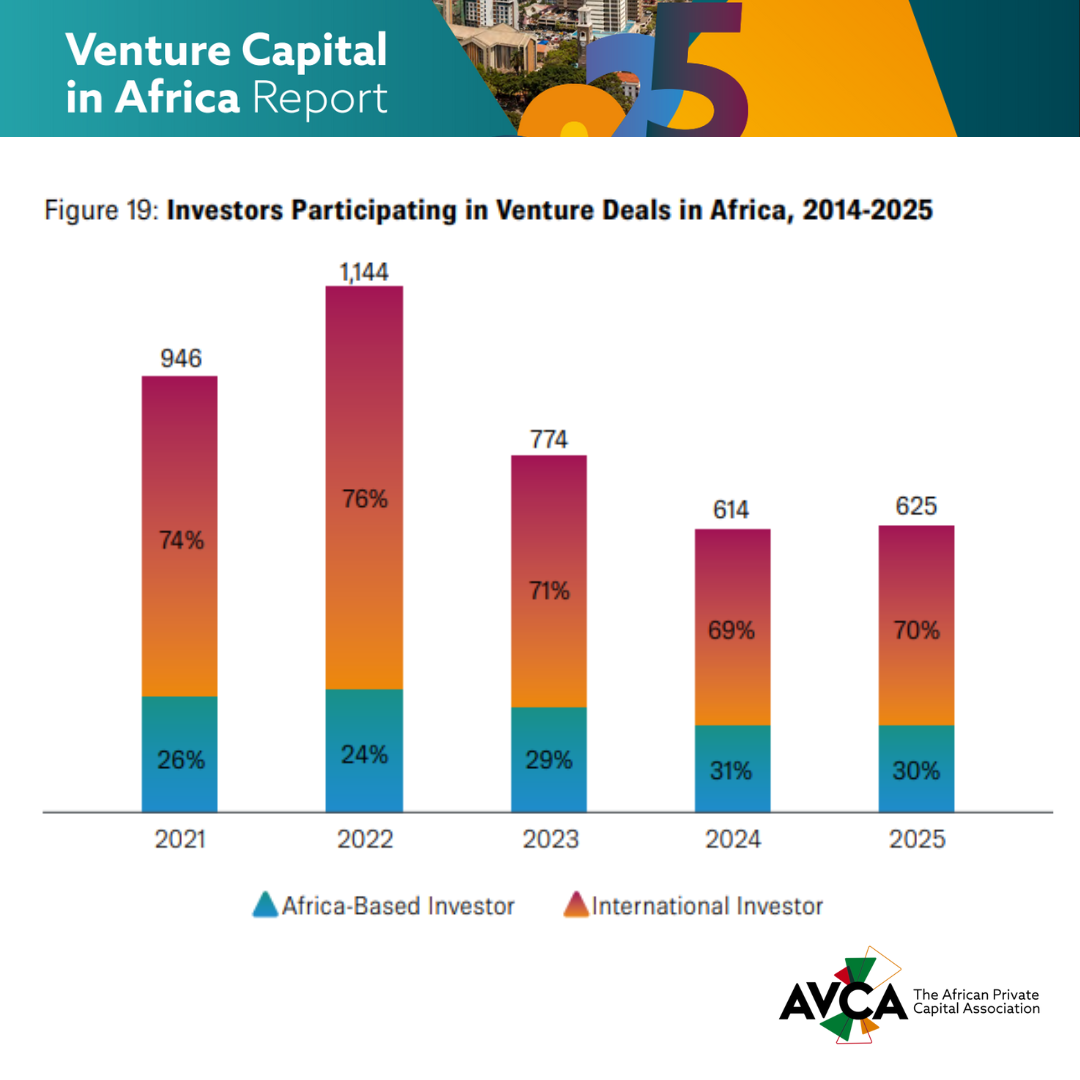

- Local Capital Remained Central: For the second consecutive year, African investors comprised one-third of all active participants in venture deals.

-

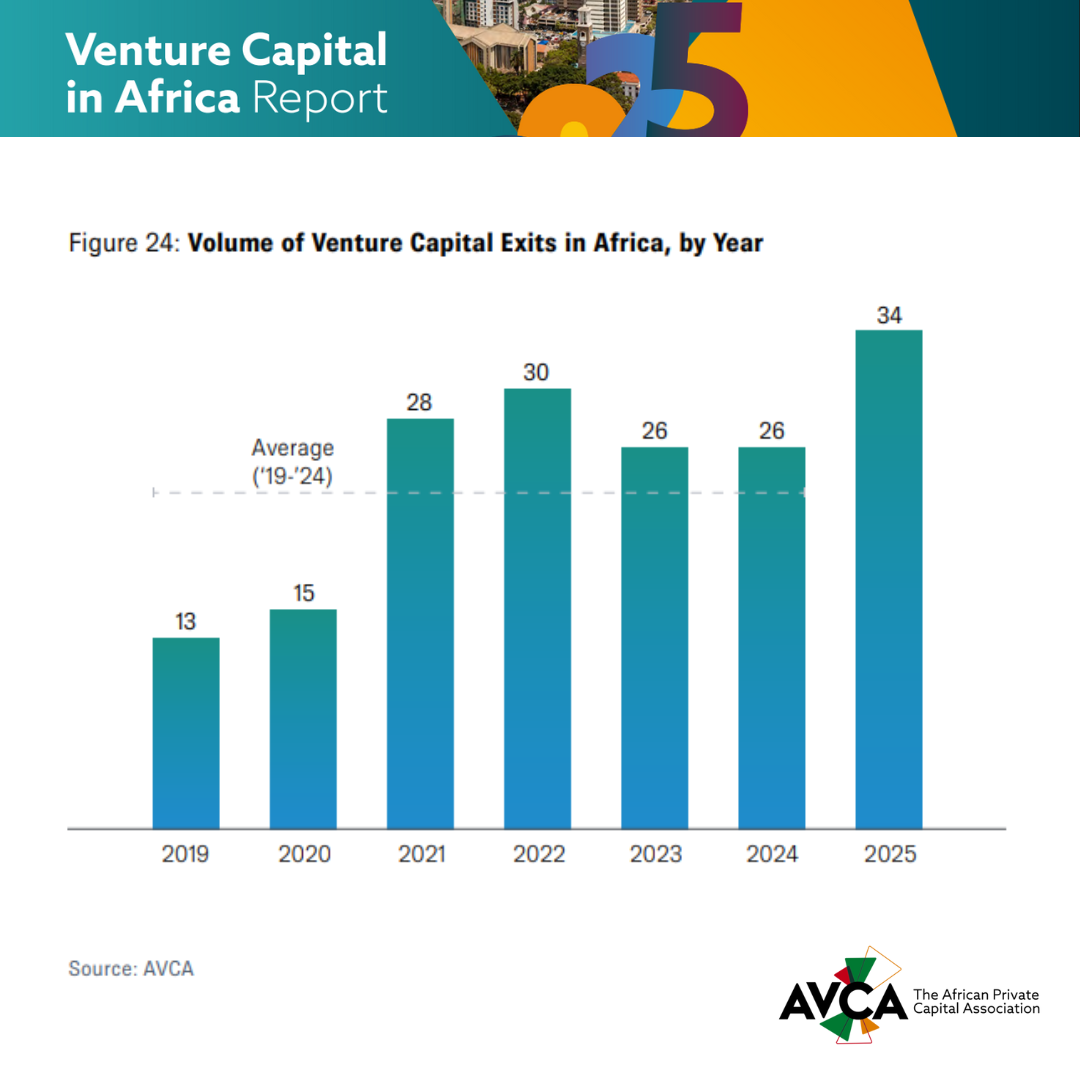

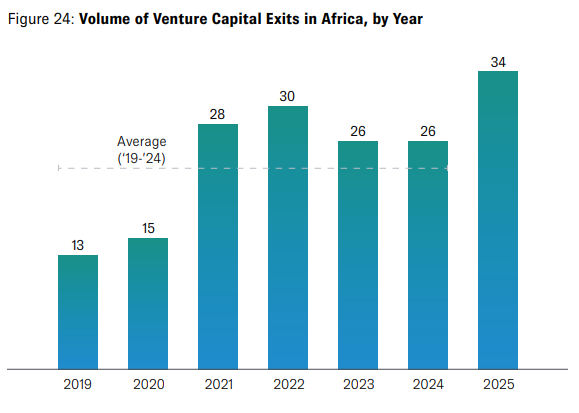

Exits Regained Momentum: Venture-backed exits rose 31% YoY to a new high of 34 exits, markedly outperforming markets globally.

-

Fundraising Contracted, New Managers Advanced: Six funds closed US$107mn as first-time managers hit a record share.

Download our shareable graphics and share the key findings with your network.

Share On: