2022 African Private Capital Activity Report

This report provides an analysis on the latest trends of fundraising, investments, and exits unfolding across the continent in 2022.

Read the public report

2022 African Private Capital Activity ReportKey findings:

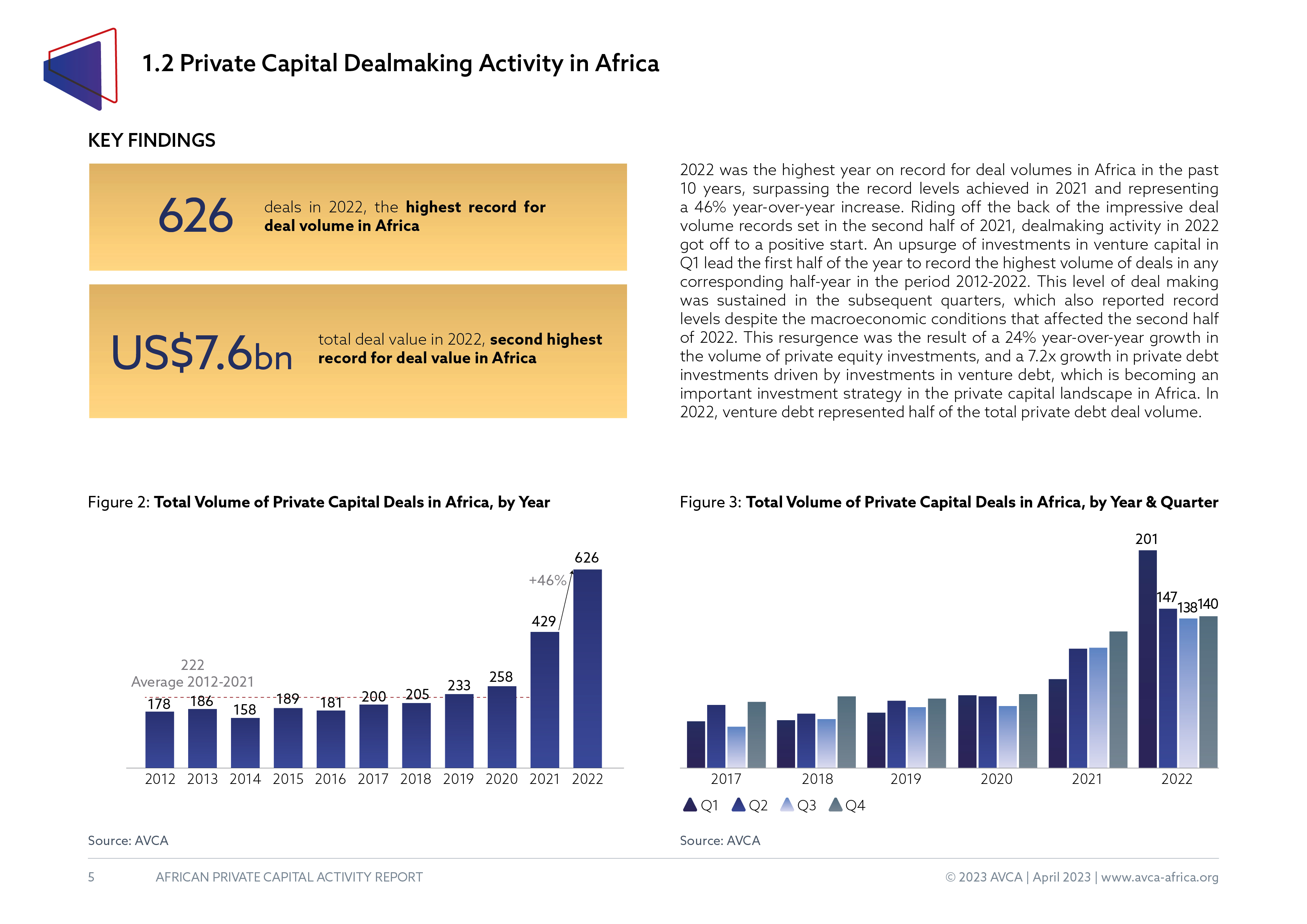

- 626 reported deals in 2022, a 46% year-over-year increase.

- US $7.6bn raised in investments.

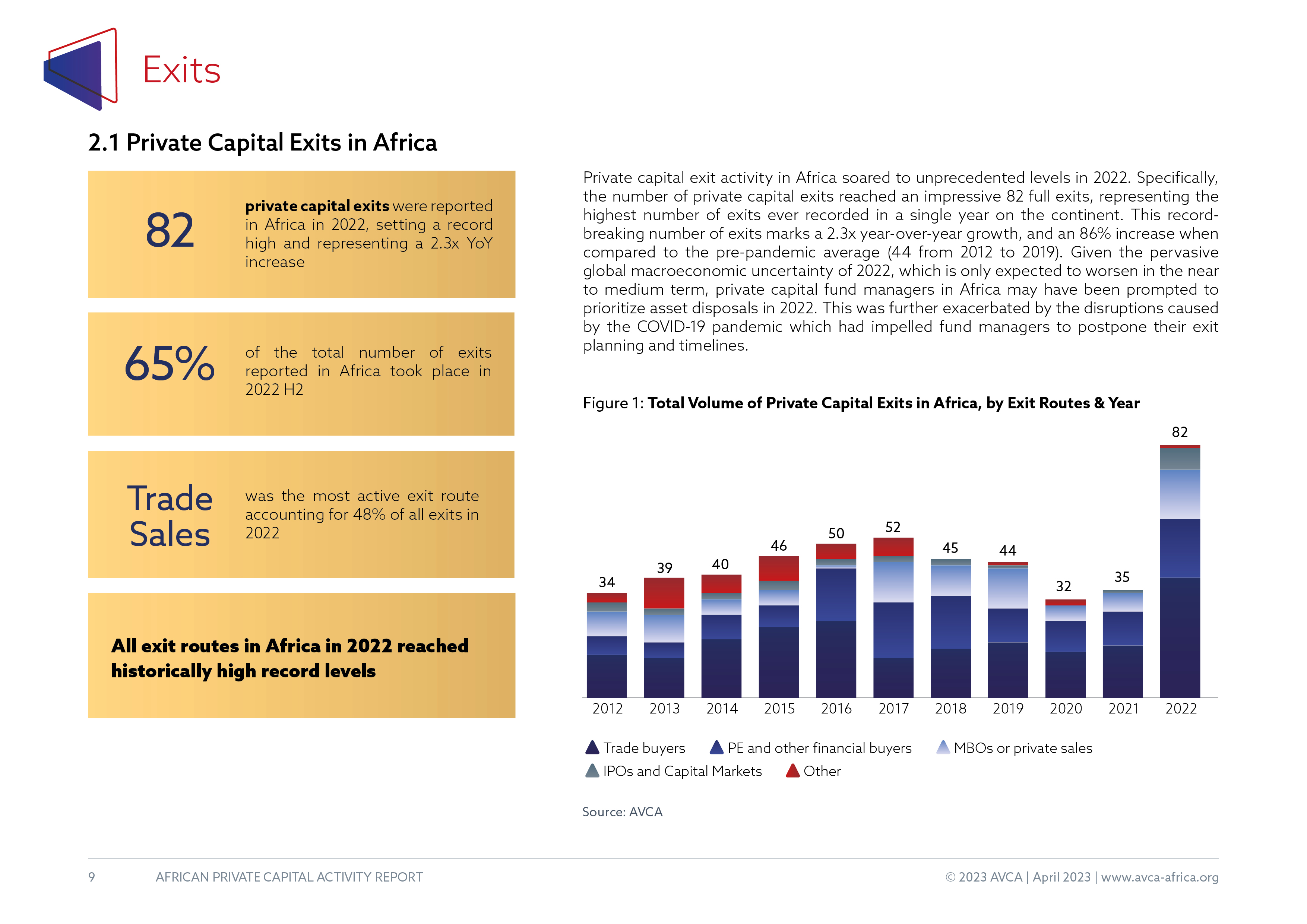

- 82 exits recorded in 2022, indicating a remarkable year-over-year increase of 2.3x.

- Sales to Trade Buyers was the most preferred exit route.

- US$2.0bn was the total value of final closed funds in 2022

- US$1.7bn reached in interim closes

Share with your network:

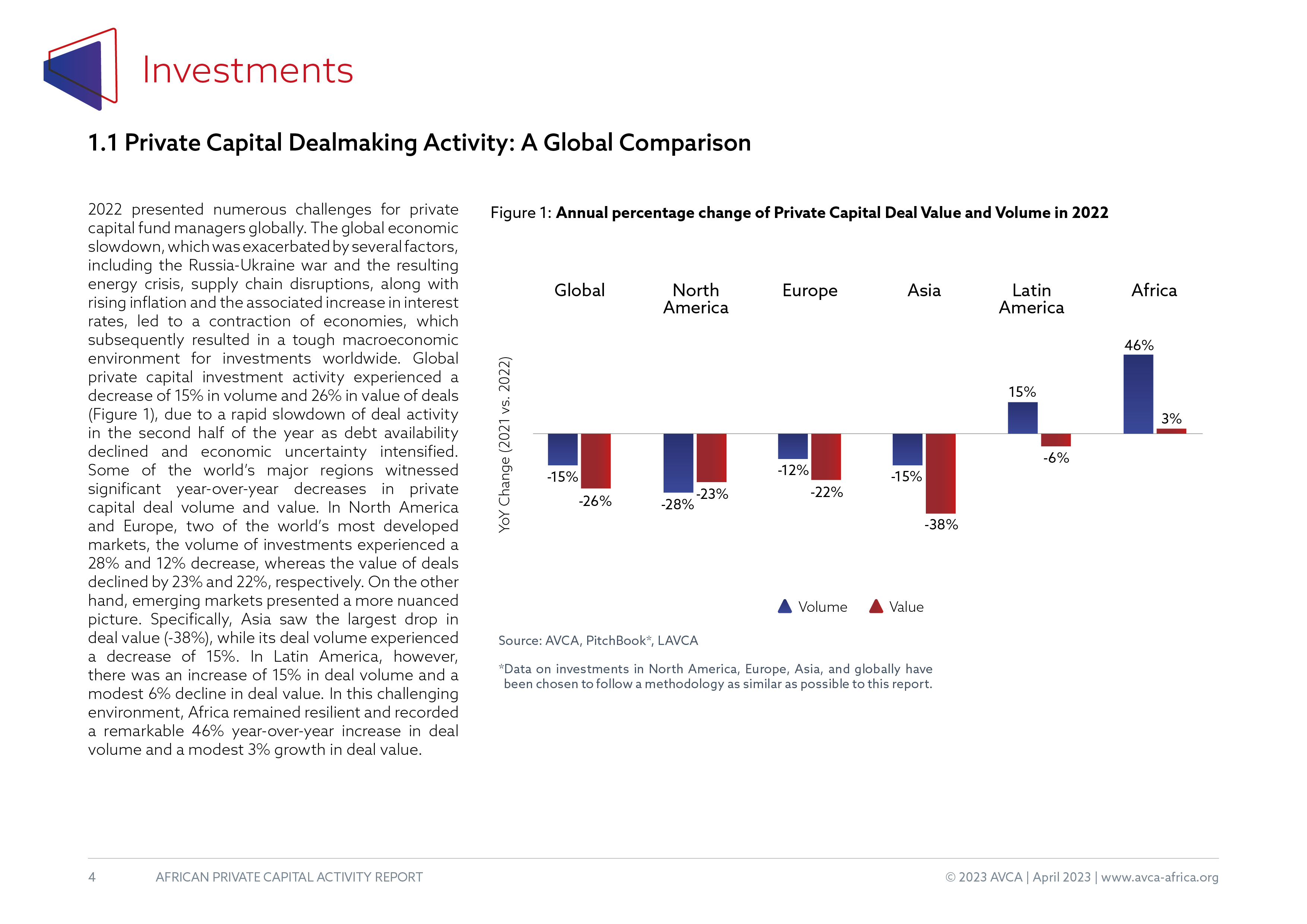

AVCA’s 2022 African Private Capital Activity report shows that despite the tough macroeconomic environment for investments globally in 2022, Africa remained resilient and recorded a remarkable 46% YoY increase in deal volume and a modest 3% growth in deal value, while some of the world’s major regions witnessed significant decreases in private capital deal volume and value.

Read the report: https://lnkd.in/eD3HkXhJ

#AVCAResearch

Despite facing numerous macroeconomic challenges in 2022, the private capital landscape in #Africa demonstrated remarkable resilience by preserving the upward trends reported in 2021. The continent recorded one of its most successful years in private capital investment activity, with both the volume and value of investments reaching impressive heights: US$7.6bn was invested across 626 #privatecapital deals.

Read the report: https://lnkd.in/eD3HkXhJ

#AVCAResearch

In May 2023 AVCA released their 2022 African Private Capital Activity report

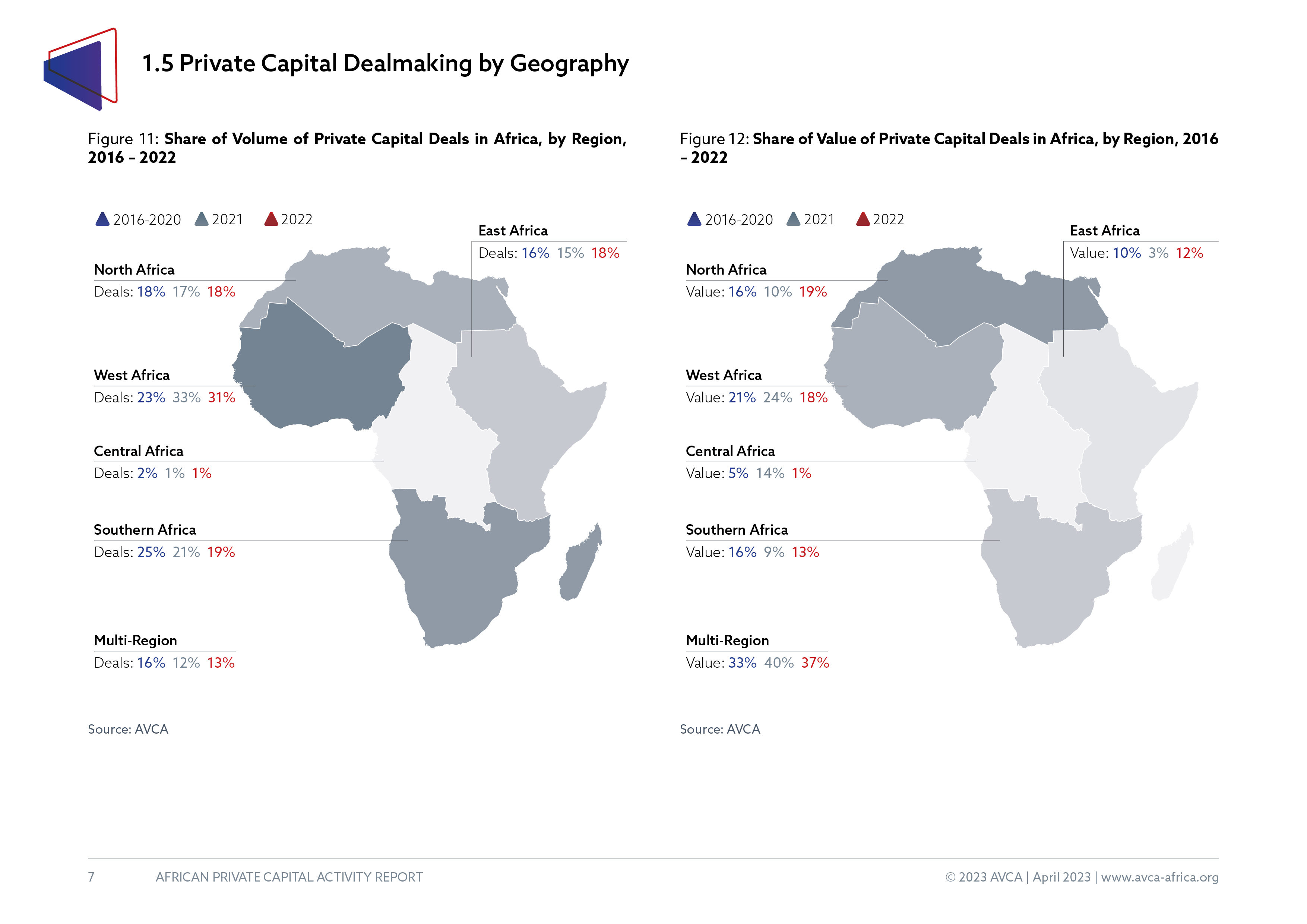

For the second year in a row, #WestAfrica attracted the largest volume of private capital deals in Africa (31%), driven by investments in Nigeria’s dynamic venture capital ecosystem. Remarkable growth was also experienced in North Africa, which had a 52% YoY increase in deal volumes and a 97% YoY increase in the value of investments to net in US$1.5bn, the highest grossing value of investments in the region in the past 10 years. Similar growth patterns were experienced in East Africa, where deal volumes nearly doubled while deal values recorded a 4x increase.

Read the report: https://lnkd.in/eD3HkXhJ

#AVCAResearch

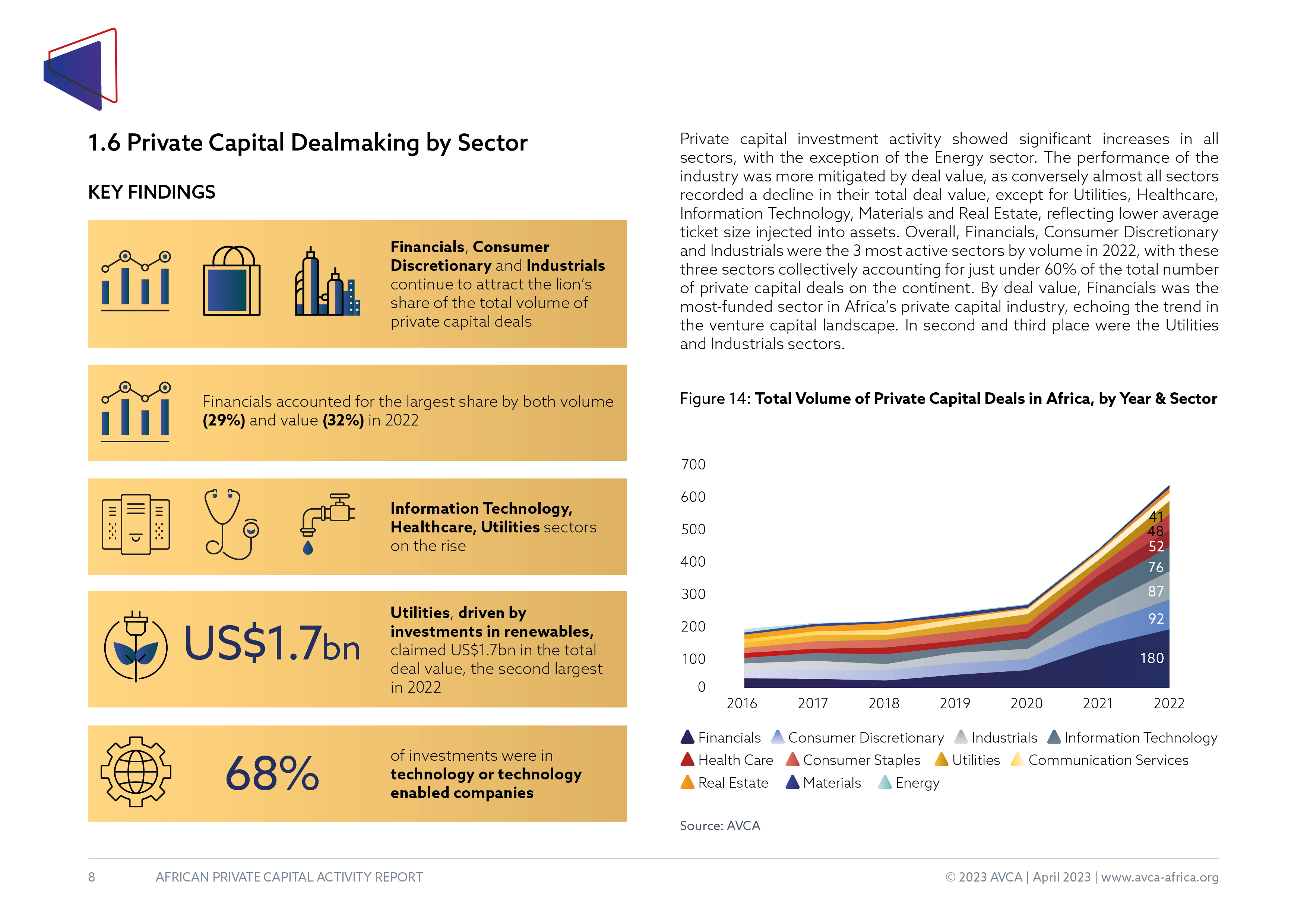

AVCA's 2022 African Private Capital Activity report has shown #privatecapital investment in the #Financials sector has been a powerful theme for the last decade, and 2022’s uncertain macroeconomic conditions did relatively little to dampen this. In aggregate in 2022, Financials accounted for US$2.4bn in private capital deployment in 180 deals, representing the largest shares of the industry’s total deal volume and value, 29% and 32%, respectively. Reaching a historical record by deal volume, the Financials sector was driven by an increase in Fintech investments.

Read the report: https://lnkd.in/eD3HkXhJ

#AVCAResearch

#Privatecapital #exit activity in Africa reached an all-time high, indicating a vote of confidence by investors in private capital-backed portfolio companies.

Learn more in AVCA's 2022 African Private Capital Activity report: https://lnkd.in/eD3HkXhJ

#AVCAResearch